- Markets @ Midday: Listen here at lunchtime or find all Market Matters Podcasts on Spotify.

A solid start to trade this morning with the main board rallying back above 7900, however, sellers kicked into gear from just before midday with the index finishing ~60pts below the morning highs. Material/Resources stocks remained solid and over 70% of the market finished higher, though it was far from convincing after a good session yesterday. We don’t believe the volatility is necessarily over but we do think stocks are looking for, or have found, a low.

- The ASX200 edged up +6ts/+0.08% closing at 7860

- Utilities (+1.7%), Property (+0.71%) and Energy (+0.60%) in the winners circle.

- Consumer Discretionary (-0.58%), Financials (-0.17%) and Staples (-0.01%) weighed.

- Gold Road Resources (GOR) -4.92% came out with a production downgrade, at their Gruyere joint venture in the march quarter due to two conveyer belt failures and other unexpected maintenance.

- West African Resources (WAF) +3.57% higher on scoping study results for their Toega underground development – the satellite mining/crushing facility to add 560,000 ounces of gold production over its 7-year life.

- New Hope Corp (NHC)+8.92% released 1H25 results surprising on earnings, announcing a strong dividend of 19cps fully franked and a $100m buyback.

- CEO Rob Bishop said thermal coal prices could soon rise given a 77% slide over the past two years has forced some rival exporters to curtail production.

- Clarity Pharmaceuticals (CU6) +10.63% jumped as Barrenjoey initiated on the stock with a buy rating and an eye watering $8.70 price target – shares closed at $2.81

- Woolworths (WOW) +1.41% enjoyed a broker upgrade from Macquarie to ‘outperform’.

- Fellow consumer staples Endeavour Group (EDV) -1.94% didn’t share the same fortune, downgraded from buy to neutral at Goldman Sachs.

- BYD (BYDD US) unveiled a new system for electric cars that the Chinese automaker says will allow them to charge almost as fast as it takes a regular car to refuel.

- The new system was capable of providing 400 kilometres of range in 5 minutes – we’ll discuss this further tomorrow in our International Equities section.

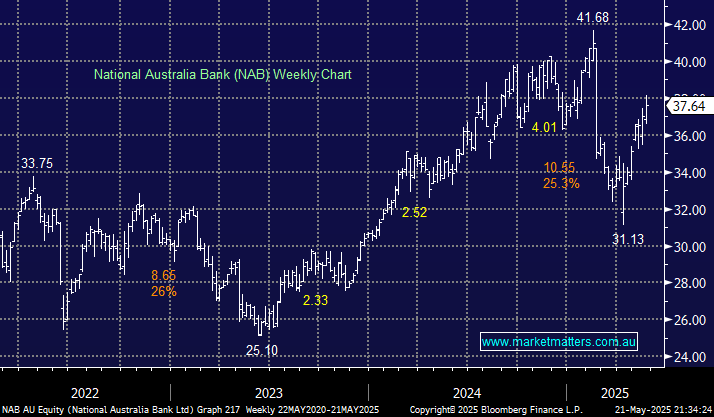

- National Australia Bank (NAB) -1.96% the weakest of the big 4 following a broker downgrade from Jarden to sell equivalent and $30 PT.

- Gold hit a new all-time high of $US3015/oz at our close.

- Positive day in Asia, Hong Kong +1.8%, China +0.10% while Japan was trading up +1.2% .

- Iron Ore in Singapore was mildly lower.