Markets @ Midday: Listen here at lunchtime or find all Market Matters Podcasts on Spotify.

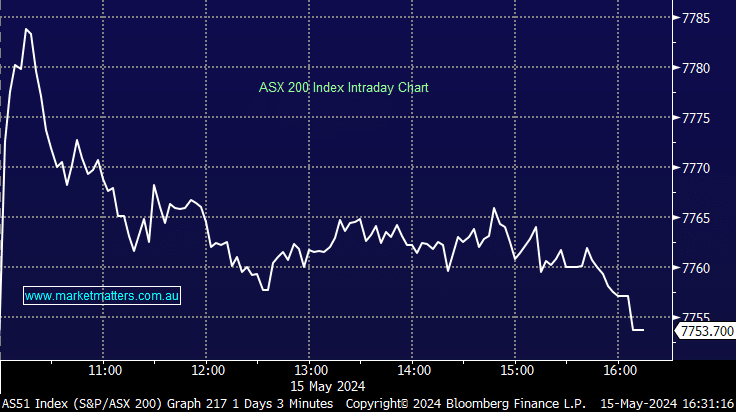

The ASX was on the front foot early today before paring gains as the session wore on in the post-budget trade. UBS thinks the budget is ultimately good for stocks given its pro-growth even though that could mean interest rates remain higher for longer. The ASX200 finished up 26pts, though this was ~30pts from the intraday high, still only 2% from the all-time high.

- The ASX 200 finished up 26pts/+0.35% at 7753.

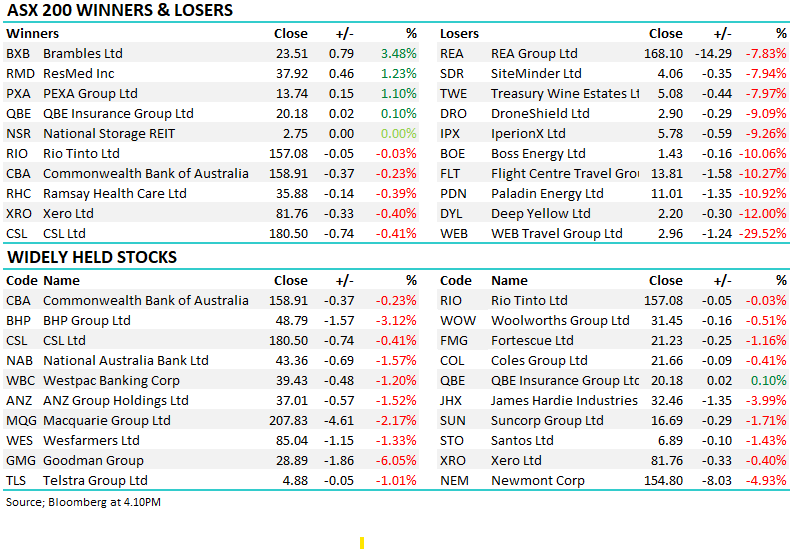

- Materials (+1.19%) was best on ground, carried by BHP. Healthcare (+0.8%) and Consumer Discretionary (+0.76%) were also well supported

- Industrials (-0.63%), Energy (-0.54%) and Financials (-0.25%) were the only sectors to close lower.

- Australia’s Wage Price Index grew at a slower than expected pace in the first quarter which is good for inflation, up 0.8%, growth slowing from the 0.9% printed in the December quarter and below expectations for 0.9%.

- On an annual basis, wages growth slowed to 4.1% down from 4.2% last quarter.

- US CPI in focus tonight, the market expecting Core inflation of +0.3% for the month, and headline 3.4% for the year.

- IRESS (IRE) -1.78% struggled after confirming some details around the security breach flagged last week. Stolen credentials were used to access their OneVue platform. Ironically, the collateral damage was worse for Praemium (PPS) -2.22% which bought the business from IRESS for $21m.

- Australian Agricultural Company (AAC) -1.42% posted an operating profit of $50.5m on the back of strong volumes across their meat business, however, weaker cattle prices forced a $150m valuation adjustment on the company’s herd.

- Silex (SLX) +2.08% we had a chance to chat to the company today regarding their latest Investor presentation. No new news, the stock carried higher by yesterday’s US ban on Russian uranium.

- IDP Education (IEL) +7.05% bounced today, the short position had climbed over 15% ahead of the federal Budget with many predicting a more aggressive stance on international students than what was delivered. Shorts covered.

- CSR unch announced FY24 results with a strong Building materials figure (EBIT $294m, +8%) offset by weak Aluminium (EBIT loss of $29m) as high electricity prices shredded earnings. The company is under takeover from Saint-Gobain at $9/sh.

- Iron Ore was softened in Asia, BHP added +2.09% after Anglo American (AAL LN) rejected their latest takeover offer.

- Asian stocks were mixed with Nikkei +0.1%, China -0.6% and Hong Kong closed.

- US Futures are more or less unchanged at our close.