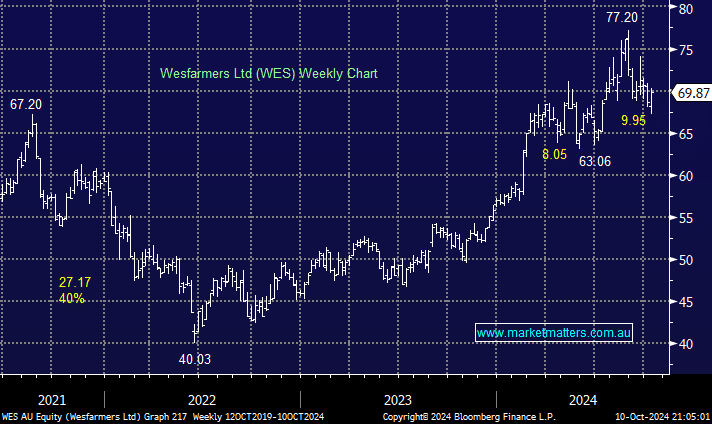

WES delivered a solid FY24 trading update in August, but disappointing early FY25 trading updates for Bunnings, Kmart Group, and Officeworks accompanied it. At the time, the stock was trading around $74, and we wrote a small note following the result, concluding MM was neutral/negative at current levels. Like much of the ASX, the stock is trading on the rich side compared to history and, in WES’s case, its peers, but another 6-8% lower will offer a good risk/reward opportunity into this diverse and defensive business. Increased price competition impacts Kmart, while a market-wide softening in building activity weighs on Bunnings. Given this backdrop, margin expansion is likely to be modest, which adds further reasons not to chase the stock at excessive valuations into strength. After struggling of late, its lithium division is back in focus after RIO’s move, but it needs higher Li prices to make money.

NB Wesfarmers has a 50% stake in a joint venture with one of the world’s largest lithium producers, SQM, in the Mount Holland lithium mine through its 2018 acquisition of Kidman Resources.

- We have been watching WES’s pullback with interest, as we hold no retail exposure in our Active Growth Portfolio since taking a profit in JBH.