The Latest Q&A

Answer

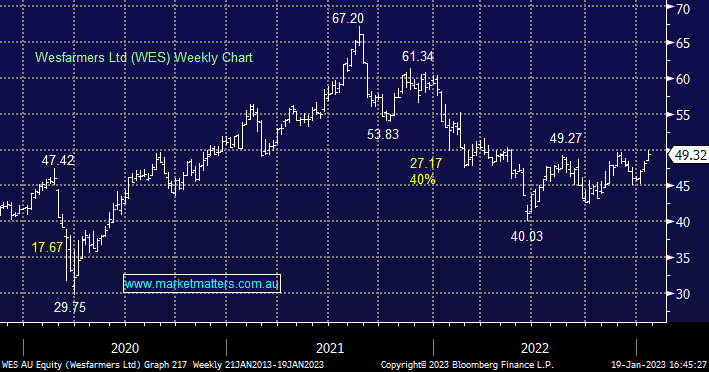

Hi Peter,

We turned more neutral on the retail stocks lately, though the data hasn’t quite rolled over yet printing better than expected last week.

Wesfarmer’s balance sheet isn’t stretched on around 2x net debit to EBITDA so we can’t see them forced into needing to divest assets at this stage. While Bunning’s is their main earner, Kmart and Target are strong contributors and they look to be improving performance here while consumers are trading down to these brands given the rising cost of living.

Overall, while pressure will build we are yet to see it come through in the data and as a result we remain neutral here.