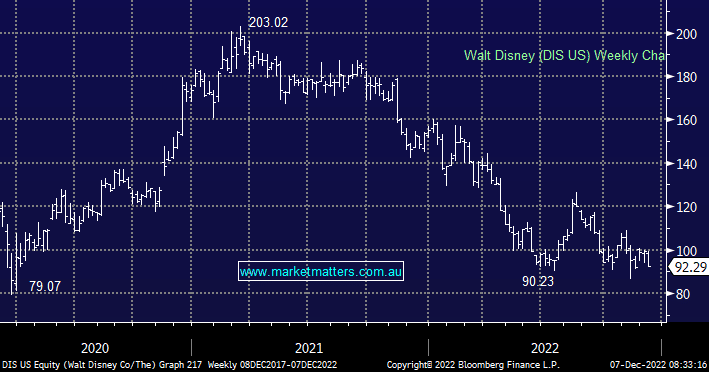

Down 12% since our high conviction call, Disney is one of the weakest on the list due a quarterly earnings result that underwhelmed while they have also just announced a ‘back to the future’ moment with the reinstatement of Bob Iger as CEO to replace his hand-picked successor Bob Chapek. We view this as positive and should drive a content-led turnaround, however, patience will be required here. Hindsight suggests that Disney would have been better off (near term at least) simply licensing their content for other streaming services, however, they made the decision to launch their own to extract the most value possible from their catalogue. This ‘should’ yield better returns over time however in the near term, it is proving costly. Short-term pain for long-term gain is the strategy at Disney. While we will give this position some room, we are not advocating aggressive buying following their weaker than expected update.

scroll

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Close

Close

Thursday 11th September – Dow off -220pts, SPI off -20pts

Thursday 11th September – Dow off -220pts, SPI off -20pts

Close

Close

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Close

Close

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Close

Close

Woodside Energy Group (WDS) v Crude Oil ($US/barrel)

Woodside Energy Group (WDS) v Crude Oil ($US/barrel)

Close

Close

MM is now more neutral on DIS US

Add To Hit List

Related Q&A

Relevant suggested news and content from the site

Video

WATCH

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Recorded Friday 20th February 2026

Podcast

LISTEN

Thursday 11th September – Dow off -220pts, SPI off -20pts

Daily Podcast Direct from the Desk

Video

WATCH

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Recorded Wednesday 10th December

Podcast

LISTEN

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Daily Podcast Direct from the Desk

chart

Woodside Energy Group (WDS) v Crude Oil ($US/barrel)

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.