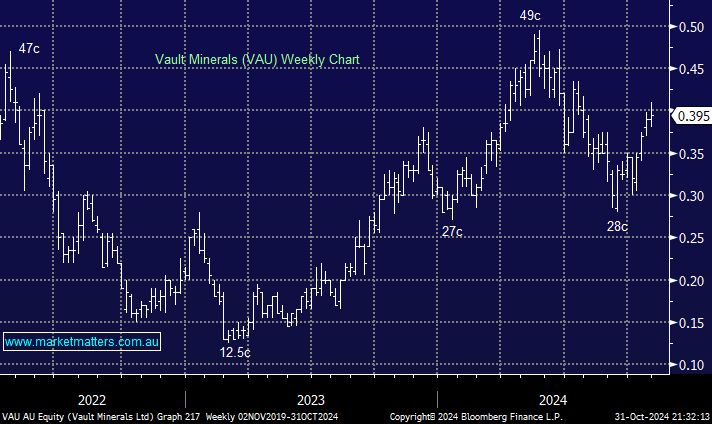

Vault Minerals (VAU) is Red 5 (RED) reincarnated on the ASX; it’s the same $2.7bn gold producer and explorer based in WA. In August, the company’s FY24 results were solid, but the stock has lagged its peers through 2024:

- Revenue of $620mn flowed through to an underlying profit of $48.5mn, and for FY25, guidance is 390-430K oz at an AISC of A$2,250-2,540.

The company has transitioned after Red5 (RED) merged with Silver Lake Resources (SLR) to become a larger entity that should benefit from scale; VAU has a stronger balance sheet and is expected to enjoy cost savings and improved mining rates. Over the coming years, we can see more M&A activity in the gold space. We hold VAU in our Emerging Companies Portfolio.

- We like VAU and can see some performance catch-up over the coming months.