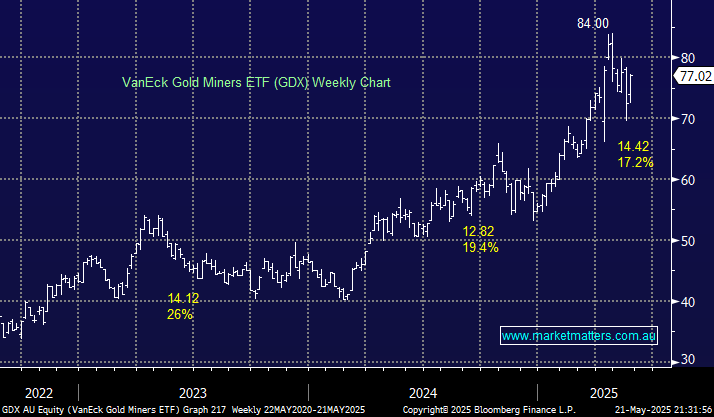

This ETF holds heavyweight gold stocks from overseas and Australia ( just 11%). Its largest three holdings are Newmont (NEM US) (11.7%), Agnico Eagle Mines (AEM US) (11.2%), and Wheaton Precious Metals (WPM US) (7.4%). In line with an appreciating $A, we aren’t surprised that the GDX looks likely to push higher than the ASX names, i.e. Gold priced in $A will underperform as the “Aussie” pushes higher, or more specifically, the $US drifts back below the psychological 100 area.

- We like the GDX ETF targeting fresh highs in the coming weeks/months, or ~10% higher.

NB “Shawn’s Trading ideas” is long the GDX ETF from $70.