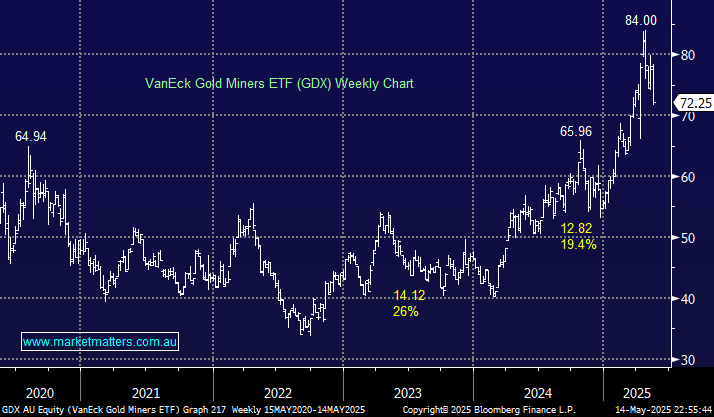

If we are correct about gold, this ETF should fall another 3-5% as it holds heavyweight gold stocks from overseas and Australia (11%). The ETF’s largest three holdings are Newmont (NEM US) 11.7%, Agnico Eagle Mines (AEM US) 11.2%, and Wheaton Precious Metals (WPM US) 7.4%.

- We like the GDX ETF in the $68-70 region, which is approaching fast.

NB “Shawn’s Trading ideas” has a resting bid in the GDX ETF at $70, which is only 3% lower.