We almost had to start with gold this morning as precious metals captured the headlines in recent weeks, both in the financial and mainstream news. On Tuesday, precious metals endured their steepest selloff in years as we saw the crowded trade unwind in classic panic-like fashion. In one day, spot gold prices slumped as much as 6.3%, the biggest decline in more than a dozen years, while spot silver dropped as much as 8.7% as selling gathered momentum throughout the day on no specific news. Gold had previously been soaring because of bets of aggressive rate cuts by the Fed, and the so-called debasement trade, in which some investors had pulled away from sovereign debt and currencies to protect themselves from runaway budget deficits and general market uncertainty.

The unprecedented queues in Martin Place, Sydney, with retail investors looking to buy physical gold, have been concerning MM – a sign the market was getting overcooked, and although the advance stretched higher than we thought likely, the chickens did ultimately come home to roost. However, the core reasons gold has driven higher are still in play, and we are now looking for a good risk/reward area to buy back gold exposure after many gold names have tumbled by ~20%. MM has donned our “buyer’s hat” towards precious metals, but the bounce in the last 24-hours has been muted with investors’ confidence dented on Tuesday. Overnight, precious metals ETFs bounced, but after gapping higher, they surrendered much of their gains to close near the session’s lows, with the previous bullish enthusiasm largely absent.

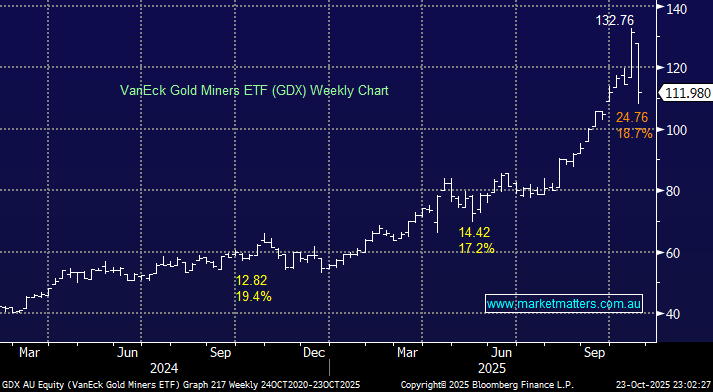

At this stage, from a risk/reward perspective, we can see the GDX having another leg lower in the coming weeks, before finding support. For subscribers not familiar with this ETF, it tracks the Global Gold Miners index, currently having 51% exposure in Canada, 18% US, 11% Australia, and 7% South Africa. It currently holds 86 stocks, with heavyweight Newmont its largest position at 12% of the ETF. We believe this is an excellent ETF with its 0.53% pa cost, reasonable considering the global exposure.

- We believe the GDX represents good buying in the 100-105 area, but this may increase in the coming weeks if the sector continues to stabilise.