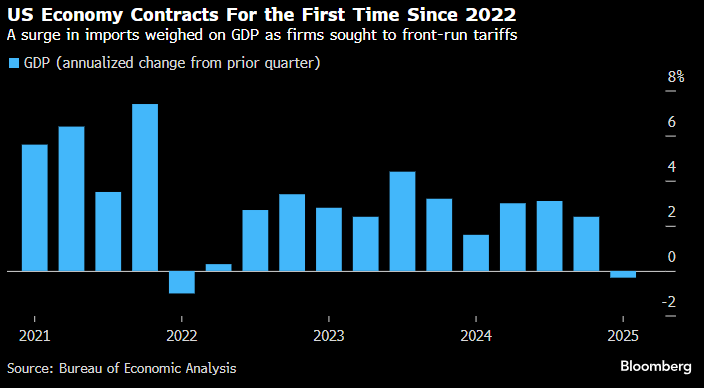

The US economy contracted at the start of the year for the first time since 2022 due to an enormous pre-tariff import surge and more moderate consumer spending, courtesy of tariff uncertainty. The markets initially reacted very negatively to the numbers they suspected were coming, with the Dow spiking down almost 800 points before the buyers returned in earnest. Inflation-adjusted GDP (gross domestic product) decreased an annualised 0.3% in the first quarter, well below the average growth of about 3% in the prior two years. As expected, the data highlight the scramble by companies to secure merchandise ahead of expansive tariffs, with net exports subtracting nearly 5% from GDP.

However, despite the contraction, the underlying details of the report suggest some key economic drivers remained on a sound footing at the start of the year. Consumer spending, which accounts for two-thirds of GDP, advanced +1.8%, the weakest since mid-2023, but still better than economists had forecast. Separate data out Wednesday showed that inflation-adjusted consumer spending climbed 0.7% last month — more than analysts expected — after an upward revision to the prior month.

- The data was overall good news for the doves, with credit markets now looking for at least four rate cuts before Christmas.

Overnight, the S&P500 illustrated underlying market strength by wiping out a 2% intra-day plunge for the first time since 2022, the last major swing low for the S&P500. The month of huge volatility ended with a bang, leaving the S&P 500 down less than 1% for April, as if nothing had happened! The market rebound was fuelled by hopes that trade talks would prove constructive, firming up sentiment, after a report that the US has proactively reached China through “various channels”. Four rate cuts also add a nice tailwind to stocks.

- We can see US stocks trading higher into Christmas with the S&P 500’s all-time high now only 9.4% away.