The S&P500 struggled on Friday, closing down 1.7%, plumbing new lows for the week after previously hitting an all-time high on Wednesday. A market trading within ~2% of its all-time high is no major reason for concern, but the US is no longer the place for “hot money.” Since Trump’s inauguration, European and Chinese bourses have significantly outperformed the US bourses, dismissing tariff worries in the process. We believe both areas will continue to deliver better returns than the US in 2025, a great illustration of how headlines can be highly misleading.

The sentiment on Friday was very much “risk off”, with the higher beta Russell 2000 small caps falling -2.9% compared to the Dow’s -1.7% drop. Elsewhere, bonds were well-supported as bets increased that the Fed would cut rates twice before Christmas following a slew of poor economic data: The University of Consumer sentiment index fell to 64.7 in February, a decline of nearly 10% and a steeper drop than expected as consumers fear higher inflation ahead from possible new tariffs, existing home sales in the U.S. fell more than expected last month, and the U.S. services purchasing managers’ index (PMI) dropped into contraction territory for February.

- We can see the S&P500 initially testing 5800 in the coming weeks, down ~3.5%.

AI Goliath Nvidia (NVDA US) is set to report on Thursday morning our time, and as we saw last week with our banks, the high-flyers have little room for error. From a risk/reward perspective, we like the sidelines. Still, NVDA is on our International Equities Portfolio Hitlist, and we’ll be keen to see how they are tracking.

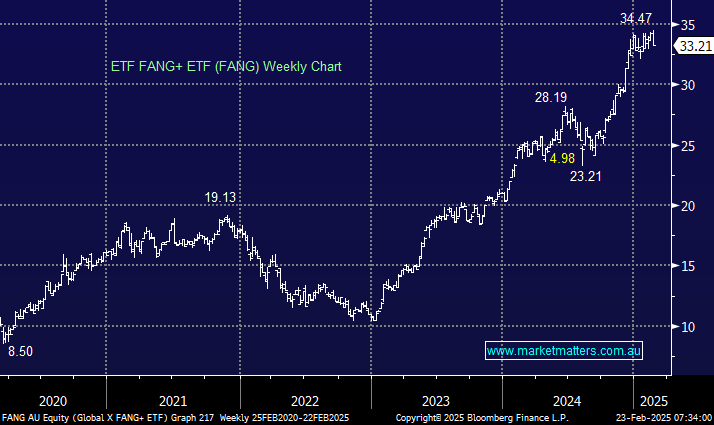

- We wouldn’t be surprised to see the FANG ETF fall ~10% in the coming weeks.