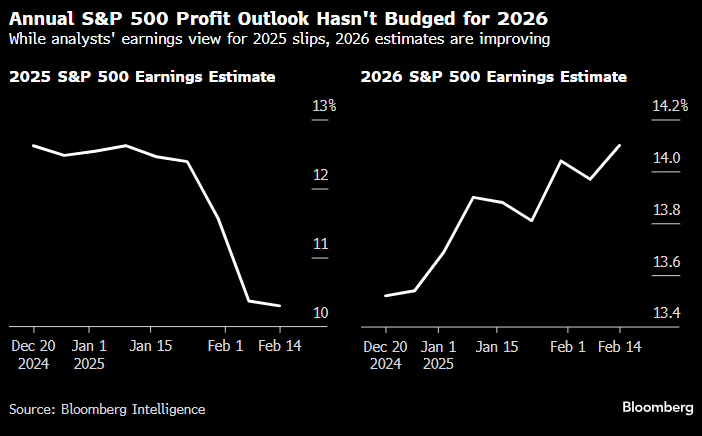

The US fourth-quarter earnings season looks solid on first impressions. However, below the surface, there’s a concerning development, which is one of the reasons we aren’t expecting 2025 to match 2024, i.e. Corporate America’s profit outlook is deteriorating short term. Among companies that have issued guidance for next quarter and beyond, more have provided estimates that haven’t met analysts’ expectations. A gauge of forward earnings that compares companies’ forecasts with analysts’ projections is the lowest in a year after plunging to a level last seen in 2016 earlier this month – data compiled by Bloomberg. The reasons for the trepidation are clear to see:

- A full-blown trade war will weigh heavily on stocks, which, in some sectors, are trading on rich valuations.

- In the US, with inflation proving sticky, the Fed looks unlikely to cut rates in the foreseeable future.

The uncertainty entering this year as Trump 2.0 gets underway is extremely high; hence, companies are delivering prudent, modest 2025 guidance. While we may see plenty of cases of “under promise, over deliver” moving forward, as expectations for 2026 illustrate, it’s unlikely to be enough to propel equities significantly higher into Christmas. The statistics add weight to our view. Since 1957, the year the S&P 500 was created, only once has the benchmark notched three consecutive years of greater than 20% advances, during the boom of the 1990s, and as stocks headed into the dot-com crash of 2000.

- We see the improving earnings outlook for 2026 supporting stocks, but another +20% year is unlikely.

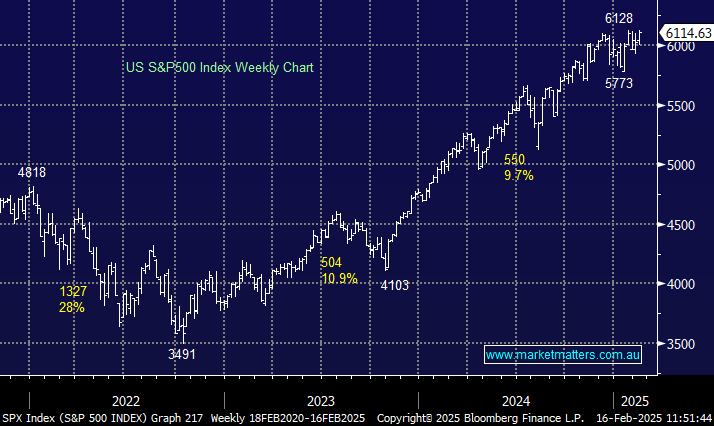

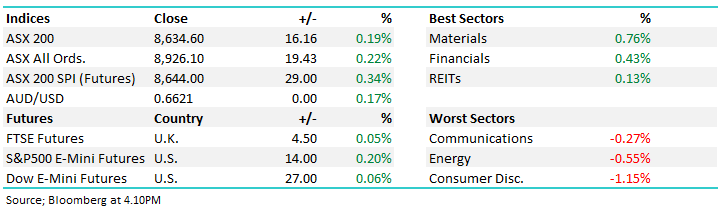

The S&P500 closed ~0.2% below its all-time high on Friday; there are no apparent concerns for the bulls yet. What is interesting as we approach the mid-point of February is the heavy lifting coming from different pockets of the market – the S&P500 is up +4% so far this year, noticeably outperforming the Magnificent Seven. While the market continues to shrug off an uncertain macro backdrop and mixed economic data, we cannot adopt a bearish stance, e.g. last week’s CPI was hotter than expected, while data released Friday showed a 0.9% slump in retail sales for January, far worse than the 0.2% decline forecast – source Bloomberg.

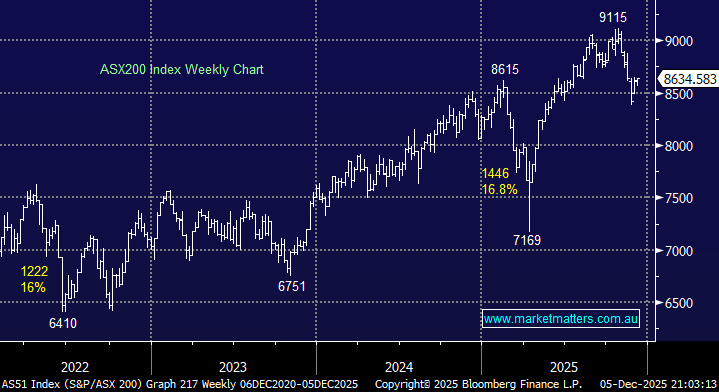

- We can see the S&P mirroring last week’s performance by the ASX, i.e. pop out to new highs before encountering selling.