The S&P 500 fell away late on Thursday night to finish the session down 0.6% with the banks leading the decline on worries about bad loans. Regional banks Zions and Western Alliance each tumbled more than 10% late in the session — Zions after taking a sizable charge on bad loans to a few borrowers, and Western Alliance after disclosing that one of its borrowers had allegedly committed fraud. Also, trade tensions between China and the U.S. continued to increase while the US Govt remains firmly shut down, adding to volatility on Wall Street with the VIX jumping 20% to test the 25 level.

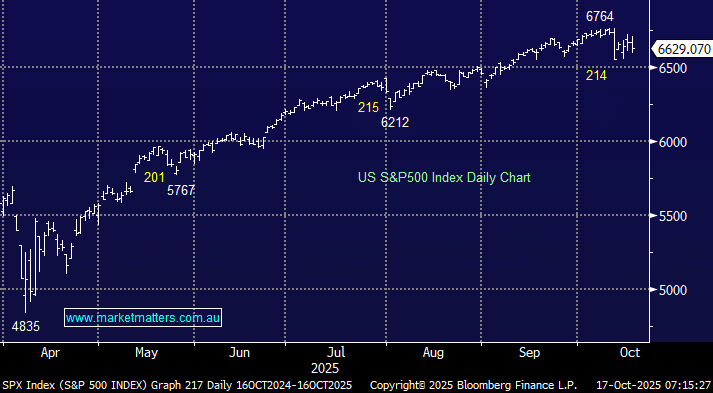

- We remain bullish on US stocks into Christmas, but over the coming weeks, another test of 6500 wouldn’t surprise.