It’s been a big 5-months at UBS after they acquired Credit Suisse in June in a shotgun wedding arranged and partially funded by the Swiss Government, the price UBS paid ($US3.2bn) is looking even more of a steal today. While the headline numbers overnight showed a loss in Q3 of $785m, its first in nearly 6-years, the traction they are getting with the CS business is becoming more obvious, with $US22bn in net new money flowing from CS clients into the UBS wealth business in the quarter (v expectations of $US14bn). Restructuring charges hurt, but these will not be ongoing and the scale benefits achieved over time will likely dwarf the price they paid.

They have been ruthless in the way they have approached the Credit Suisse business, particularly their investment banking operation which will reduce by around 2/3rds, while they are cherry-picking the rest. Margins show how they are attracting CS clients, offering very low borrowing rates to onboard wealthy clients initially and establish/reform the relationship, with other areas like trading to benefit over time from the bigger pool of capital. While this integration will take a few years, UBS have made a good start which sets them up for a solid 2024.

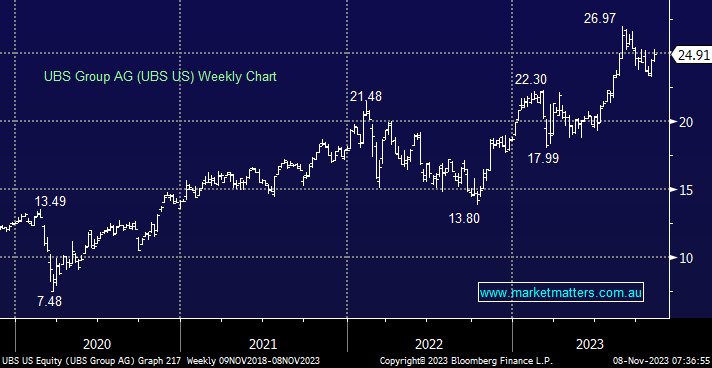

- UBS edged higher overnight on the solid update and looks destined to break recent highs, above US$27.00