UBS, the world’s largest global wealth manager, recently highlighted a shift in sentiment among their ultra-high-net-worth clients. While previous commentary pointed to investor caution amid global uncertainty, UBS now reports that “Our client conversations and deal pipelines indicate a high level of readiness among investors and corporates to deploy capital, as conviction around the macro outlook strengthens.” Renewed confidence among the super wealthy has positive implications for sustained strength in asset prices globally.

In investing, optimism often pays. Markets trend higher over time, and one of the best ways to leverage that rising tide is by owning businesses that manage capital and assets. As asset values rise, so too does revenue, and for companies with high fixed costs, that incremental revenue typically delivers outsized margin expansion—boosting earnings disproportionately. This dynamic explains why asset managers often outperform in rising markets (and can underperform in downturns). Timing, therefore, is critical.

When conditions are favourable, we believe asset management businesses represent a very good investment opportunity. In our International Equities Portfolio, we hold two key exposures to this theme: Blackstone (BX US), the world’s largest alternative asset manager, and UBS (UBS US), the leading global wealth manager. We also hold Goldman Sachs (GS US), which has exposure to these dynamics, albeit to a lesser extent.

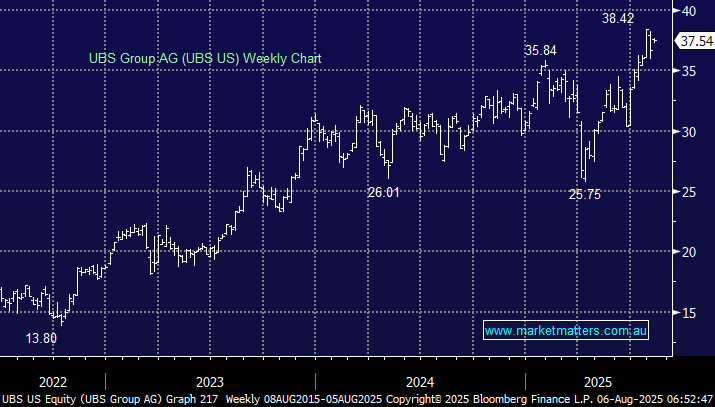

Our initial UBS thesis centred on its acquisition of Credit Suisse and the step change it would bring to UBS’s global footprint. While integrating any bank acquisition is complex, UBS has so far executed well. One near-term challenge remains: regulatory capital requirements, with Swiss regulators pressing for higher capital buffers or selective asset divestments. UBS, however, is maintaining a growth mindset. Although no new clarity on capital requirements was provided in the latest update, the stock’s stability (a contrast to the previous quarter’s volatility) suggests growing investor comfort that UBS will resolve these issues, unlocking further growth potential.

This regulatory uncertainty has weighed on UBS’s share price relative to peers, leaving it trading at 14x estimated 2025 earnings, despite consensus forecasts projecting average earnings growth of around 20% over the next three years (including 2025).

- We continue to view UBS as an attractive holding, well-positioned to benefit from rising investor confidence and global asset growth.