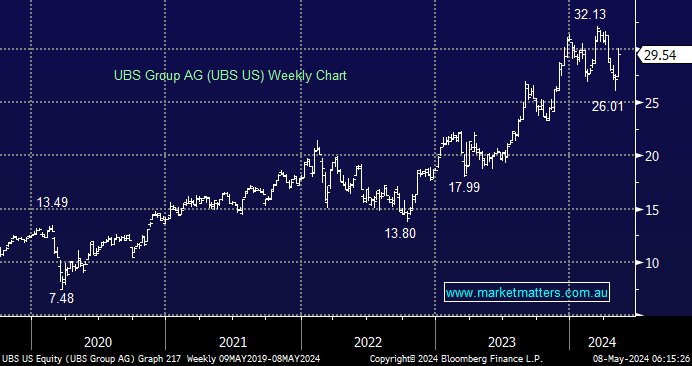

The power of scale was on show overnight, with UBS reporting materially better 1Q results right across their diverse operation as they started to reap the benefits of the emergency takeover of Credit Suisse. The Swiss investment bank returned to profit and beat earnings expectations, with all core divisions topping forecasts. A strategy of simplification, focusing on the profitable areas of the business and being ruthless in cutting legacy areas was the key, and this pushed shares up more than 10% in Switzerland before a 7% move played out in their US-listed stock, its strongest session in over a year.

- Total revenue of $12.74bn beat the $11.86bn expected.

- 1Q Net Profit After Tax (NPAT) of $1.76bn smashed consensus of $598.3m.

- Earnings per share (EPS) of 52c vs 18c expected.

- Expenses of $10.26bn came in lower than the $10.75bn pencilled in by the 26 analysts that cover the stock.

- Tier 1 equity of 14.8% vs 14.4% expected

A top-line beat on revenue and better cost management drove a big beat on profits, while their capital position was stronger than expected. Wealth management was a standout and their progress on the Credit Suisse integration seems to be going to plan.

- We expect upgrades to flow through on these results.