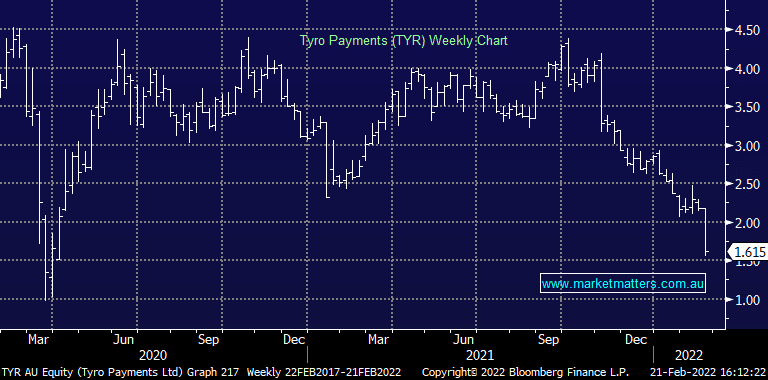

TYR -25.92%: a very weak first half result today saw significant pressure put on shares in the payments solutions business today. Tyro saw transaction volume and revenue jump around 30% each, but EBITDA fell 67% to $2.8m on higher costs. There was a significant jump in merchant numbers but transactions were weighed on by extended lockdowns in NSW and Victoria. Costs were also up, the company noting wage inflation, higher investment costs associated with their Telstra partnership and recent Medipass acquisition and extending assistance to merchants including deferring fee increases. The result was a decent miss to expectations and they are now well behind the 8-ball in terms of meeting full year expectations. There was an obvious (large) seller of the stock in the market today.

scroll

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Buy Hold Sell: The best and worst performers of FY25

Buy Hold Sell: The best and worst performers of FY25

Close

Close

Friday 11th July – Dow up +192pts, SPI up +27pts

Friday 11th July – Dow up +192pts, SPI up +27pts

Close

Close

MM is reviewing its position in TYR

Add To Hit List

Related Q&A

Buy/Hold/Sell

Thoughts on IEL, LOV, FDV and TYR please

TYR SCG CCP & RMD

Your thoughts on TYR, MFG & CCP please

What are your thoughts towards the TYR situation?

Is TYR being regarded as BNPL stock?

Thoughts on TYRO (TYR) Payments?

Emerging Companies TYR and ZIP a hold or sell?

Does MM see trading Opportunities in ELO, EML or TYR?

Is it time to take tweak some positions?

Questions on Tyro Payments (TYR), Northern Star (NST) & Neometals (NMT)

TYR & LVMH question

Relevant suggested news and content from the site

Video

WATCH

Buy Hold Sell: The best and worst performers of FY25

James Gerrish & Henry Jennings

Podcast

LISTEN

Friday 11th July – Dow up +192pts, SPI up +27pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.