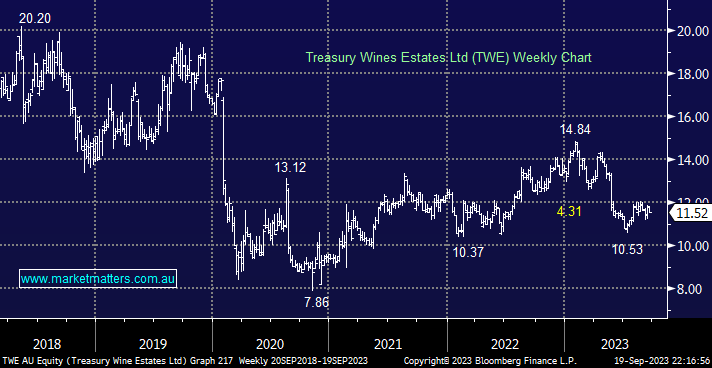

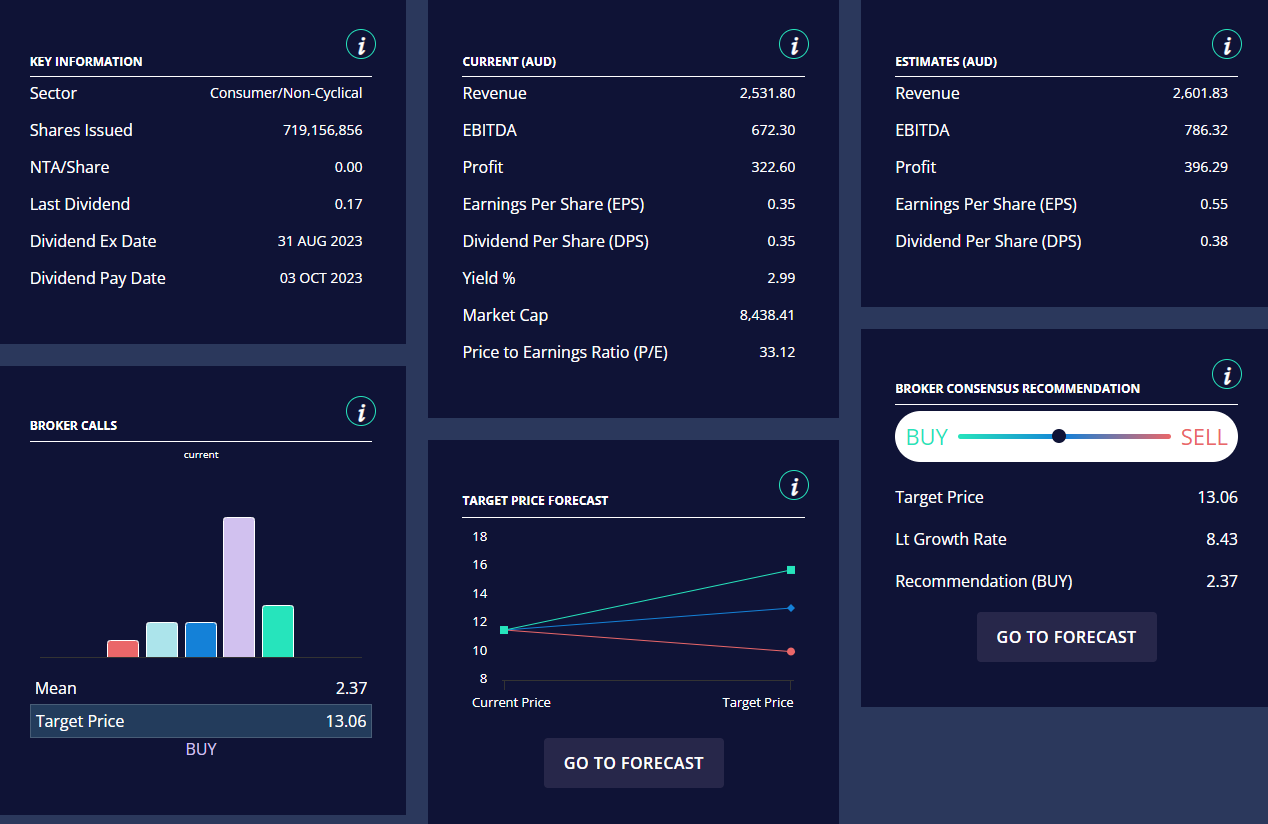

TWE’s recent FY23 result was In line with prior guidance, the company reiterated high-single-digit average earnings growth long term, led by Penfolds as the main contributor to the bottom line. They also noted the potential for a review of duties on Australian wine by China, with the recent barley decision a positive, in our opinion, the share price doesn’t reflect any potential reopening of the Chinese market:

- TWE Est P/E for FY24 of 21.2x is a -7% discount to its 5-year average.

Over half of TWE’s sales are through its premium brand, Penfolds, which should support the company through the current uncertain economic times while helping it to grow profits at a compounded rate of around 15% over the coming three years without any help from China. TWE has really delivered since China effectively closed its door to Australian wine by expanding its distribution internationally. The product that was originally destined for China has been transferred to other markets. In some cases, with a focus on premium and luxury, the brands could actually do better. Everything reads well, hence the obvious question being, why is the stock lagging?

- We believe TWE has struggled because it is often regarded as a defensive stock, and this has become a very crowded space ex-COVID.

A quick glance at the Market Matters Website for TWE shows analysts are skewed toward the buy/strong buy side of the ledger, which, along with the market’s penchant for defensive plays over the last 12-18 months, suggests “the market” might be a touch long TWE hence it’s likely to take a little time to washout the weak holders before we can see some outperformance – we believe the fundamentals warrant some patience.

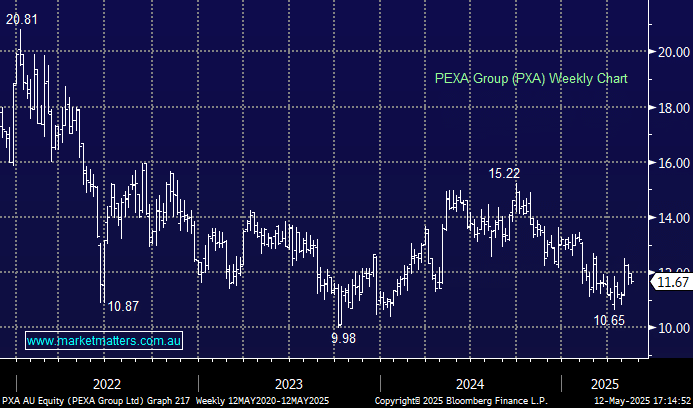

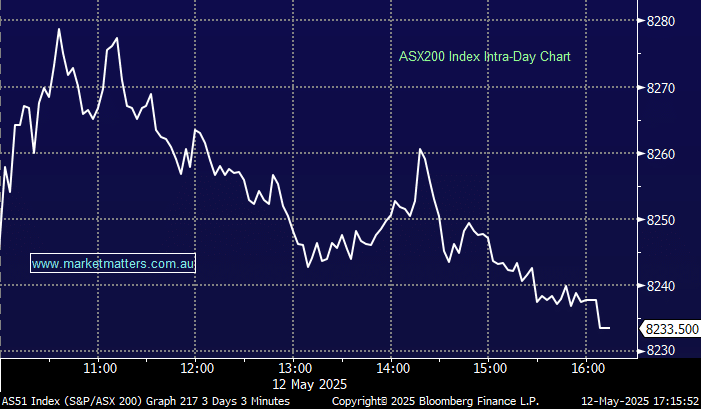

The market has been treading water for the last few months, and we could see this being ongoing, with a break above $12 required to potentially trigger some technical “Buy” triggers.

- We would be accumulating TWE if we held no position; hence, we are comfortable remaining long.