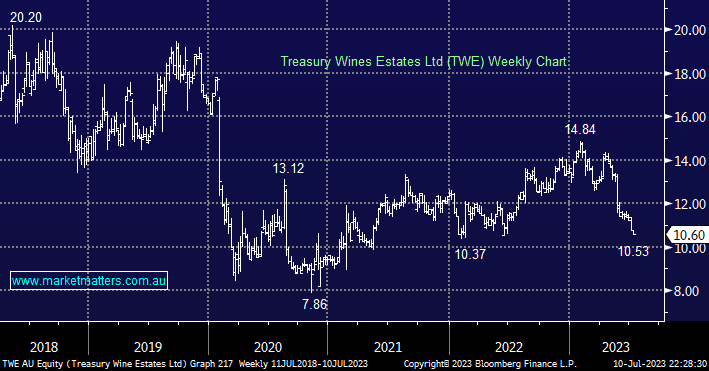

We are long TWE in our Flagship Growth Portfolio and it’s been an uncomfortable ride so far including a downgrade in May, not an ideal outcome for a “crowded trade” that is also looking to China for an injection of growth if/when painful tariffs are removed. In May they forecast growth of 11% to 13% on FY22 however, earnings came in around 3% below consensus, and the stock has dropped closer to -25% since! With luxury brand Penfolds being over half of TWE’s global earnings we believe the company should be well-positioned to withstand an economic slowdown with the current dramatic move primarily being a function of too many people being long at the start of 2023 i.e. a classic “crowded trade”.

- We see excellent value emerging in TWE as investors start to throw in the towel.