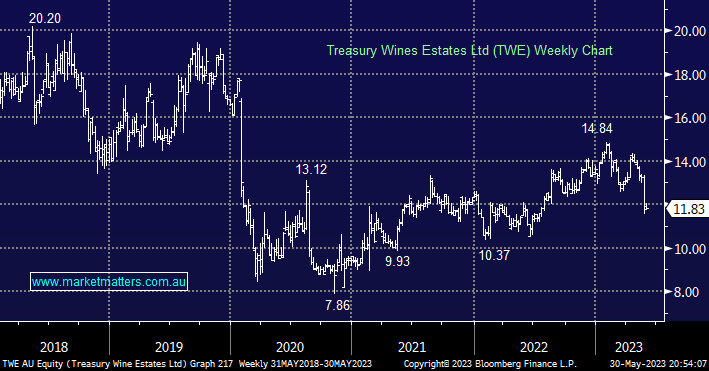

Treasury Wine Estates (TWE) is a premium-focused global wine company that was demerged from Foster’s Group (Australia’s largest brewer) more than a decade ago. Following in the theme of the past few weeks this morning we have focused on one of our positions that’s not performing as we would like posing the important question – “should we sell, reduce or add?”.

TWE disappointed the market last week when it announced FY23 estimates below expectations due to weakness in the Americas & Premium Brands (TPB) partially offset by growth in Penfolds. They recut FY23 guidance and now expect earnings (EBITS) of $580m-$590m, which represents growth of 11% to 13% on FY22 but this was around 3% below consensus. The company is enduring category & company-specific issues in its sub-US$ 15/bottle premium wine with the risk that this could become a long-term challenge for the business.

However, we are fans of TWE management believing they can execute their plans as they did when China originally closed its doors to Australian wine. The company is currently continuing to re-jig their business to focus on the premium segments that achieve better margins plus they are looking to reduce costs which all makes sense to MM.

- We continue to like TWE due to Penfolds enjoying strong distribution growth with exciting optionality as China travel retail recovers & Chinese duties on Australian wine could be removed.

However, we don’t believe the stocks overreacted to the poor guidance with the shares now trading on a 24x valuation for FY23 hence we aren’t planning on increasing our position.