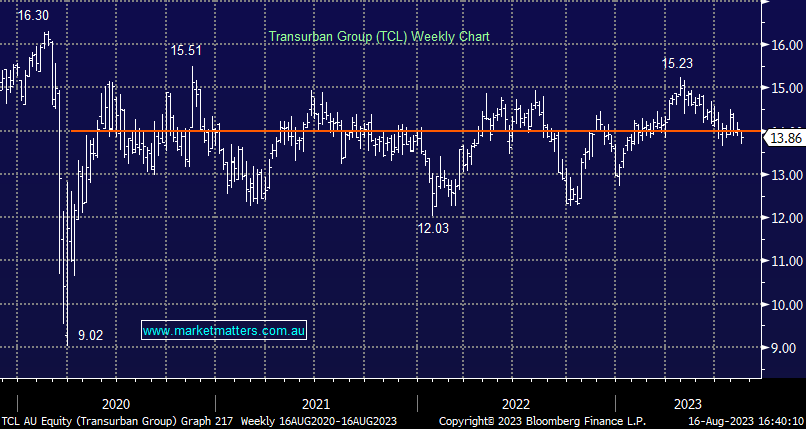

TCL -0.72%: The toll road operator reported FY23 results that were a touch light on. Proportional EBITDA of $2.448m was ~2% below consensus while the dividend of 58cps had already been announced. For FY24, they expect distributions of 62cps (v 62.5cps consensus), but they mentioned this was likely to include WestConnex cash previously held during construction (which is 3-4cps), which implies a softer underlying result, although worth bearing in mind, they like to upgrade distribution guidance through the year and this could give some ammunition to do that. While debt is high, it’s 96% hedged as you’d expect while inflation-linked tolls should also help with top-line growth. TCL also announced a new CEO, the impressive Michelle Jablko to take the reins from retiring CEO Scott Charlton.

scroll

Question asked

Question asked

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Close

Close

Thursday 11th September – Dow off -220pts, SPI off -20pts

Thursday 11th September – Dow off -220pts, SPI off -20pts

Close

Close

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Close

Close

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Close

Close

Monthly Update: Portfolio performance and positioning during October

Monthly Update: Portfolio performance and positioning during October

Close

Close

MM remains neutral TCL, having sold at higher levels.

Add To Hit List

Related Q&A

Is TCL a utility or an industrial ?

Our opinion on TCL and MQG at their current prices?

Relevant suggested news and content from the site

Video

WATCH

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Recorded Wednesday 10th December

Podcast

LISTEN

Thursday 11th September – Dow off -220pts, SPI off -20pts

Daily Podcast Direct from the Desk

Video

WATCH

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Recorded Thursday 20th November

Podcast

LISTEN

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Daily Podcast Direct from the Desk

Video

WATCH

Monthly Update: Portfolio performance and positioning during October

Recorded Thursday 6th November

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.