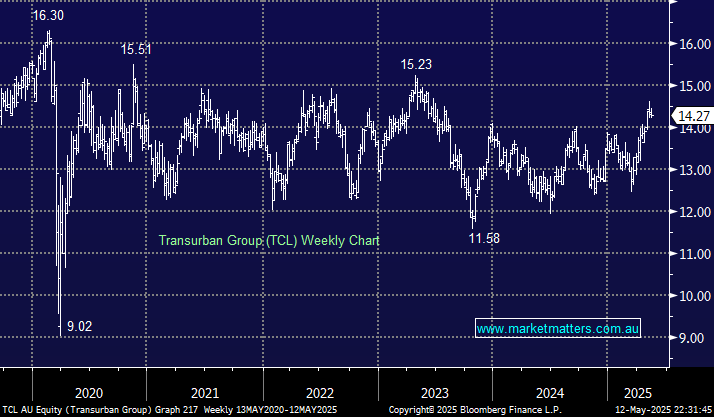

Toll road operator TCL has been a beneficiary of the safety bid over the last year, but as it posts new 18-month highs, we believe it’s fully priced from a relative valuation perspective, with fewer rate cuts expected over the coming year (s) and its safety bid set to run out of steam – from a pure defensive yield perspective we prefer APA Group. However, at this stage of the cycle, there’s no real standout buys in this area of the market for MM, hence we’ve gone off-piste somewhat and picked a tech stock that’s struggled through 2025 for several different reasons.

We last looked at Wisetech (WTC) in April, and the stock screens on the cheap side for it’s level of growth and important position in global supply chains. Richard White is now knuckling back down to business. The logistics software provider has been under scrutiny from a governance perspective, and another major investor selling cannot be ruled out, but the fact that WTC is in discussions to acquire New York-listed supply chain platform provider e2open for up to $3.5 billion highlights things are getting back on track.

- We see little upside for TCL through 2025, whereas WTC could add +20% in the blink of an eye – not a like-for-like comparison!