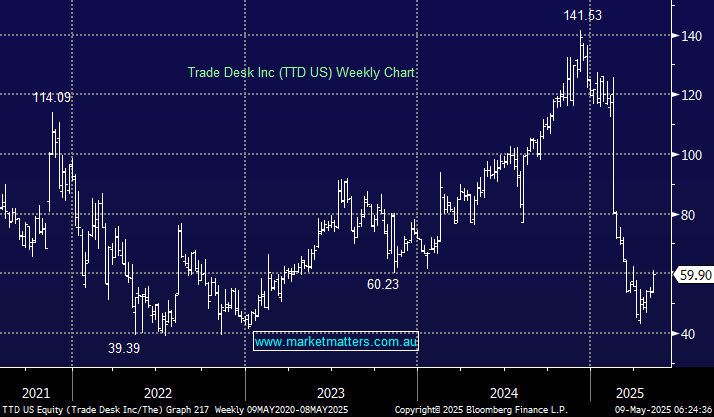

Trade Desks surged higher after Q1, and EPS beat estimates after the closing bell, sending the stock up around 14% in late trade. The outlook also looks solid, with management confident that second-quarter revenue will come in above $US682mn; the street is currently looking for $US682.7mn.

- March quarter revenue of $US616.mn, up 25.4% YoY, came in well above the $US576 consensus estimate.

- March quarter EPS of 33c came in well above the estimated 25c.

- 2nd quarter EBITDA is forecast at $US259mn, above the $US254.6mn estimates.

Like the market, we were pleased with this result and believe the stock has turned the corner and we expect am ongoing re-rate higher in the shares given how bearish the market had turned following their weaker Q4 results 3 months ago, which was their first miss in almost forever.

- We remain bullish TTD, initially targeting the $US80 area but the stock could easily move well beyond that: we own TTD in our International Equities Portfolio.