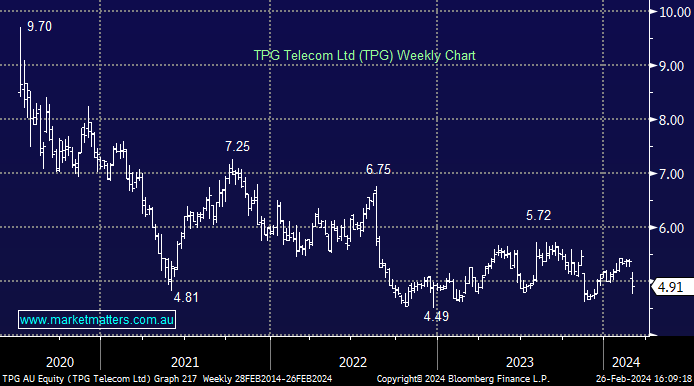

TPG -8.02%: A poor FY23 result today for the telco as increasing competition and a high debt burden bite. Revenue of $5.54bn was up 2% YoY but below $5.59bn consensus, however softer margins hurt earnings (EBITDA), which came in at $1.87bn v $1.92bn expected. They declared a 9cps fully franked dividend. They wore a significantly higher than-expected interest bill as well as higher than-expected capex, with the latter theme set to continue for the year ahead.

- All too hard for TPG at the moment, and we prefer Telstra (TLS) and Aussie Broadband (ABB).