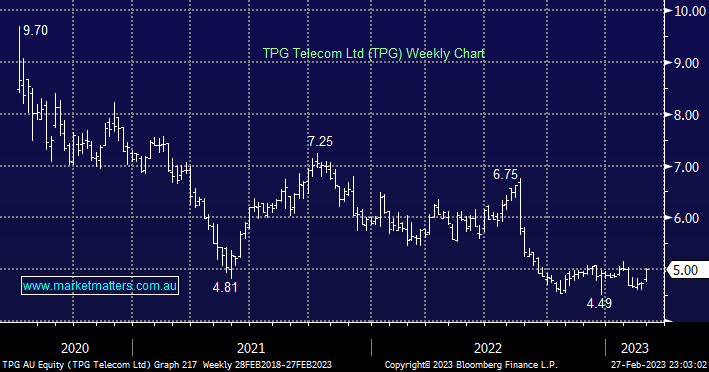

TPG was the ASX200’s best-performing stock yesterday rallying +5.9% on a day when over 80% of the market fell. The stock rallied on Monday after delivering a strong result which saw $140mn in cost savings through business synergies while the average revenue per user rose +1.9% plus guidance was ahead of consensus expectations. This $9.3bn business is forecast to yield 3.5% fully franked over the coming 12 months which is useful but not as attractive as its larger rival.

Australia’s 3rd largest telco doubled their fixed wireless customers as the focus on NBN proves successful – I know they will be getting Shawn soon if Telstra doesn’t lift their game! The company also raised revenue by +2.3%.

- We see limited downside for TPG after it’s rerating lower over recent years but conversely in our opinion it’s not an exciting story today.