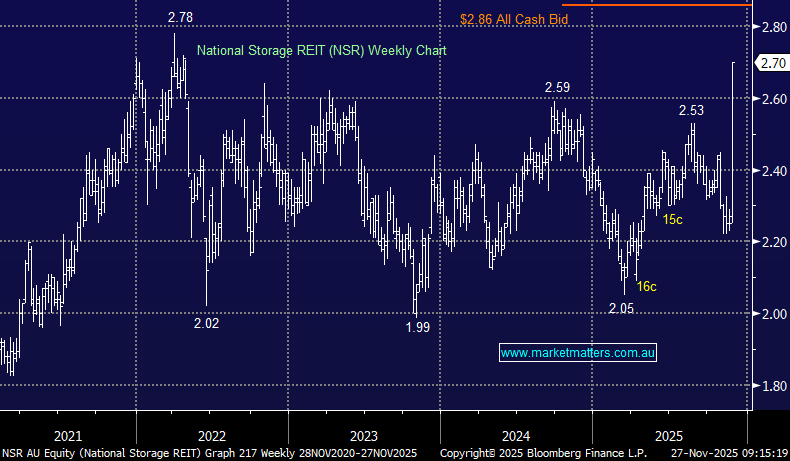

Wednesday saw the strong possibility that another ASX name will come off the boards after National Storage (NSR) received a $2.86 all-cash offer from Brookfield Asset Mgt. and Singapore’s GIC – a healthy 26.5% premium to its last trade. The $4bn bid shouldn’t come as a major surprise, with a potential takeover being one of the reasons MM owns NSR in its Active Growth and Active Income Portfolios, with a 5% weighting in each. This isn’t the first time NSR has been “in play”, but it may be the last:

- In early 2020, NSR confirmed receiving a non-binding takeover proposal from Gaw Capital.

- In February 2020, Public Storage (U.S. REIT) + Warburg Pincus (private equity) made an indicative offer of about $2.40 per security.

- Covid ended this potential bidding war.

NSR is Australia’s largest self-storage operator, with a large network of 270 centres generating recurring revenue, making it attractive to real-estate investors trying to consolidate the fragmented storage sector. NSR said it will let the bidding group carry out exclusive due diligence until Dec. 7 in order to generate a binding offer. The company said it aims to strike a deal with the suitors by that date, and everything sounds very positive at this stage.

Deal activity has increased in recent weeks after a fairly lacklustre year of M&A activity worth ~$70 billion, a 30% decline from the same period in 2024. While the number of deals remains healthy, they’ve just been smaller.

- We believe this deal has a good chance of being successful, hence selling at $2.70, a 6% discount to the bid, feels too early.