Tesla is far more than just the cars we see on the road. Through its Megapack and Powerpack systems, the company has become the world’s largest provider of grid-scale battery storage, supplying utilities and data centres with energy systems that balance renewable generation. Its Gigafactories in the U.S. and China produce lithium-ion cells for both vehicles and grid applications.

In 2025, Tesla’s energy storage division is forecast to contribute 12–15% of total revenue and capture around 15% of the global storage market. The company expects 50% growth in energy deployments this year, and analysts increasingly view this segment as a core profit engine – one that could rival or even surpass automotive margins over time. As the grid modernises and AI-driven power demand surges, energy storage provides Tesla with steadier earnings and diversification from the cyclical EV market. What began as a side venture has evolved into one of Tesla’s most profitable and strategically vital businesses.

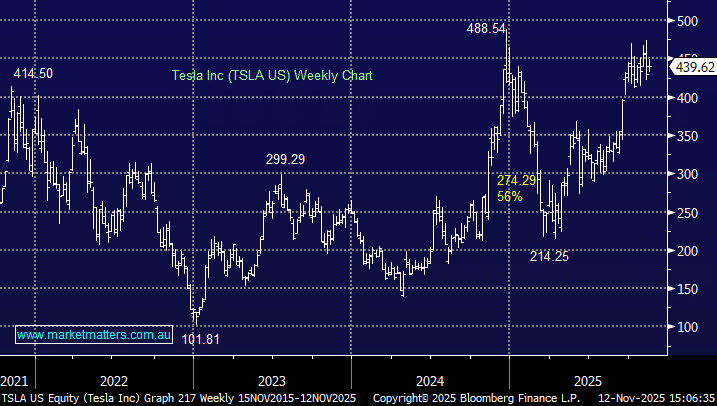

Buying Tesla gives investors a lot more than a pure play energy storage investment, but it is decent part of the business. We have not owned Tesla stock in the past, and we still have some reservations about doing so in the future, however it’s hard to argue that Musk and Tesla will not be at the forefront of this massive change in energy consumption and storage.

- We like TSLA but acknowledge there’s a lot of moving parts in the $US1,460bn giant.