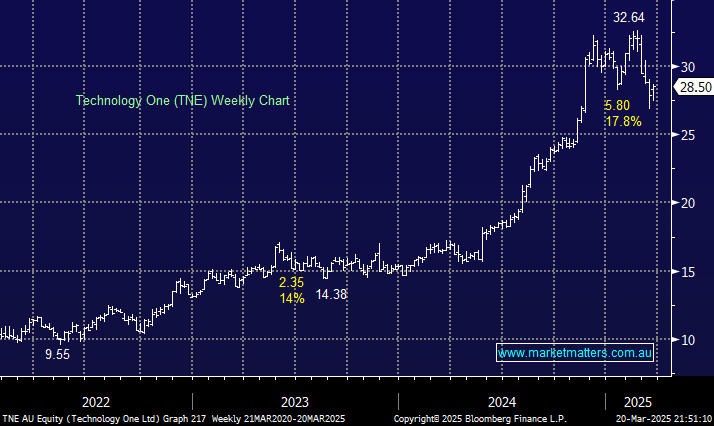

TNE bounced +3% on Thursday as the enterprise software solutions company attracted some bargain hunters. This is an excellent business with a recurring annual revenue of approximately $470 million. We believe that TNE can achieve its goal of $1 billion in annual recurring revenue by FY30; however, much of this is already reflected in the share price, even after its nearly 18% pullback.

- We like this growth stock, which has a solid earnings base and pays a small dividend. It looks good at around $28, but we would leave room to add into a deeper pullback towards $25.