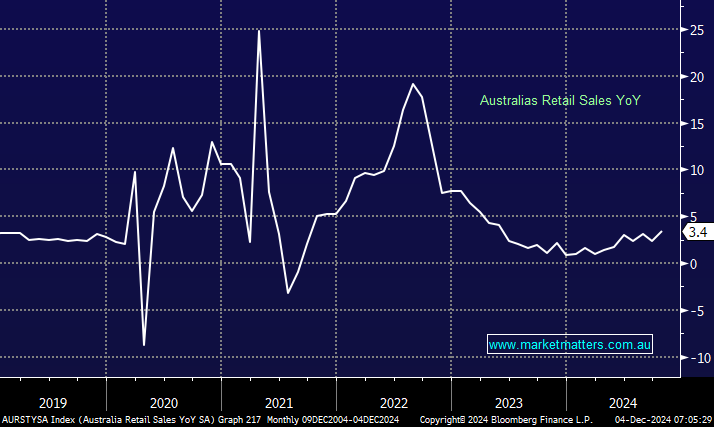

As the operator of BCF, Supercheap Auto, Rebel and Macpac SUL is a company MM has covered several times in recent months, but as we hold no retail exposure in our Active Growth Portfolio, it’s a sector we’re watching closely. The Australian consumer is starting to spend their tax cuts as we approach Christmas; retail sales for October’24 grew by +0.6% MoM, while YoY, the jump to 3.4%, was the fastest since May’23. The signals on the consumer are mixed, but we believe net positive:

- Wages appear to be softening, but deposits are growing as people save the government’s recent tax cuts.

We are looking for a modest recovery by the local consumer over the coming year, a view supported by improving consumer sentiment; all we need is a rate cut by Michelle Bullock, and 2025 could be an excellent year for the sector – MM is looking for one cut this FY. However, we caution that the risks are increasing toward the RBA moving later and by less as government stimulus keeps inflation elevated, e.g. electricity price subsidies, scheduled to expire at the end of 24/25, will be extended.

- MM believes the Australian consumer is well-positioned into 2025; hence, we’re revisiting the sector this morning.

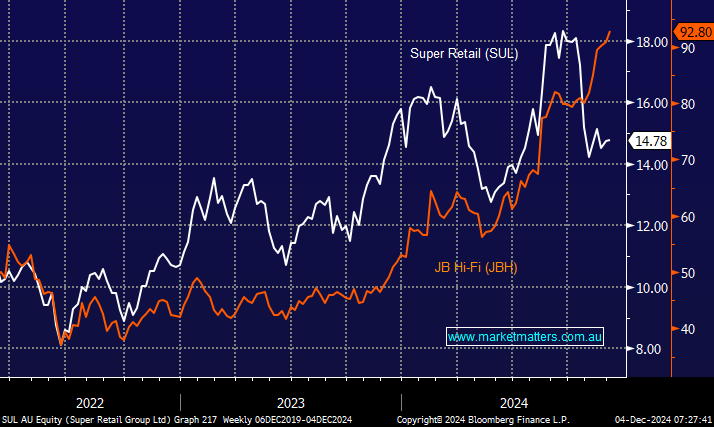

Selling strength and buying weakness, especially on valuation grounds, has generally reduced alpha (performance) in 2024, with the strong getting stronger and vice versa. The recent comparative performance/valuations within the retail space illustrate this perfectly:

- JBH has soared +77% in 2024, outstripping our expectations; the stock is now trading almost 50% above its 5-year average valuation. It’s a great company, but it’s too expensive for us.

- SUL has slipped 4% this year following a trading update in October that flagged a deceleration in sales momentum. This resulted in minor consensus downgrades for FY25 earnings estimates; the stock is now trading only 6% above its 5-year average valuation

Hence, the obvious question is whether we should consider the “hot” JBH or SUL as we approach Christmas. The first part of the equation is straightforward: JBH’s lofty valuation is too rich for us, even though this is a quality operator. Conversely, even after an average trading update in October, we believe the risk/reward is far better for SUL:

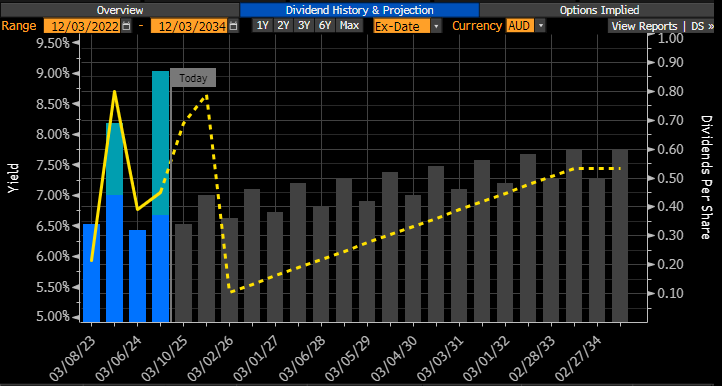

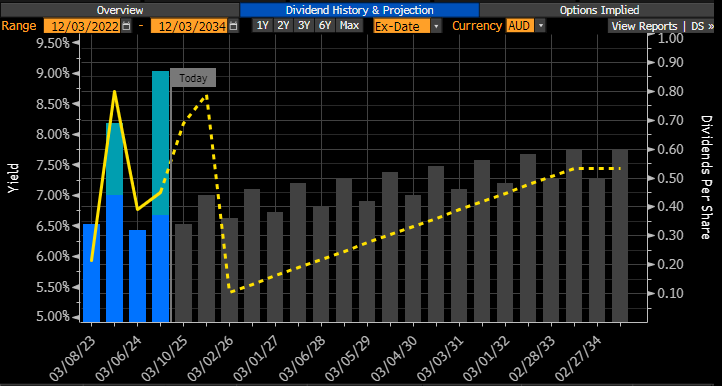

- SUL’s valuation isn’t demanding, while its estimated 5.3% fully franked yield over the coming 12-months makes it easier to be a patient holder of this retailer.

- Conversely, JBH looks/feels very capable of correcting 10-15% when the market rerates the high valuation stocks; when, not if, in our opinion. JBH is only forecast to yield 2.5% over the next 12-months; hence, the reason to buy this household name is further capital gain, which is a big ask in our opinion.

We believe SUL offers better value and risk/reward at current levels.

SUL plans to open 25 more stores this FY, which points to ongoing growth, assuming margins can be maintained. Also, there are only 21 days until Christmas, which is usually a great time for retail names. SUL has enjoyed an average December gain of +3.8 % for the last 20 years. With a more realistic bond market now only looking for three rate cuts by the RBA into the 1Q of 2026, we don’t see frothy rate cut expectations built into the retail sector. It may take time, but we can see the performance of these two quality retailers converging in 2024.

- We like SUL for retail exposure at current levels – MM holds SUL in its Active Income Portfolio.