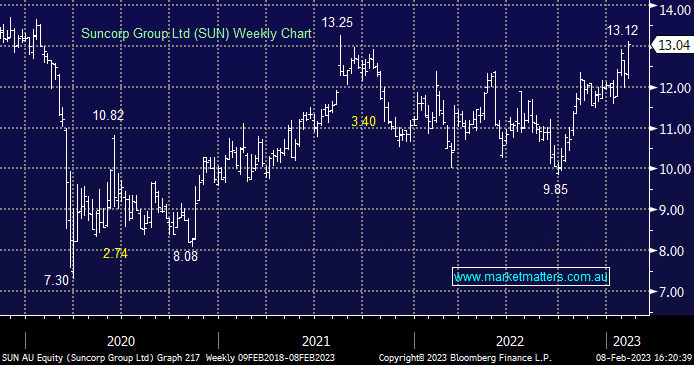

SUN +4.57%: Rallied today after posting a mixed 1H23 update. Cash NPAT was around 7% below consensus at the group level, however, General Insurance (GI) margin was solid and their soon-to-be-jettisoned banking division did particularly well, with Net Interest Margins (NIM) of 203bps, ahead of expectations. They reaffirmed key guidance measures and the momentum, particularly at the top line (gross written premiums of $4.9bn up 8%) is good.

scroll

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Gerrish: The correction is done, we’re positioning for what comes next

Gerrish: The correction is done, we’re positioning for what comes next

Close

Close

A discussion with Geoff Wilson – Wilson Asset Management & James Gerrish – Market Matters

A discussion with Geoff Wilson – Wilson Asset Management & James Gerrish – Market Matters

Close

Close

Friday 9th May – Dow up +254pts, SPI up +3pts

Friday 9th May – Dow up +254pts, SPI up +3pts

Close

Close

MM is getting more optimistic on SUN

Add To Hit List

Related Q&A

The Performance of Suncorp (SUN)

ANZ purchase of Suncorp

Thoughts on SUN

Q&A -weekend report – SUN

Q&A -weekend report – DRO & SUN

Thoughts on Suncorp (SUN) please

ANZ’s Suncorp Take Over

Thoughts on the ANZ / SUN potential sale

Dates on Suncorp divestment to ANZ please

What is MM’s current view on Suncorp (SUN)?

Does MM like SUN after its strong rally?

What are MM’s thoughts on the ANZ – SUN tie up?

Banks & / or insurers as rates rise?

Semi Conductors

How do you get the yield on the SUNPI?

Relevant suggested news and content from the site

Video

WATCH

Gerrish: The correction is done, we’re positioning for what comes next

The Market Matters lead portfolio manager talks the recent recovery, Trump, gold, and why he thinks there's plenty of opportunities.

Video

WATCH

A discussion with Geoff Wilson – Wilson Asset Management & James Gerrish – Market Matters

Recorded Monday 31st March

Podcast

LISTEN

Friday 9th May – Dow up +254pts, SPI up +3pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.