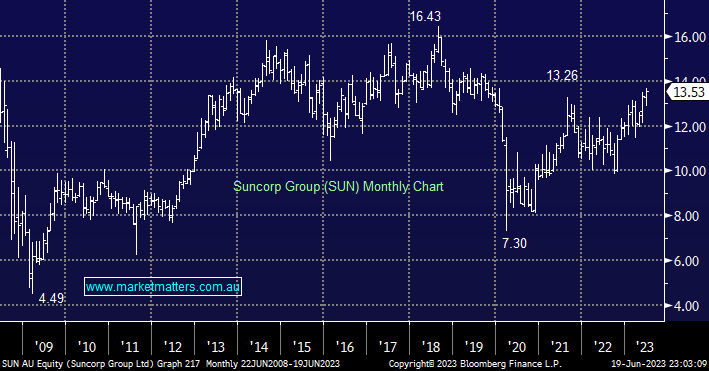

SUN has rallied strongly through 2023 making fresh 3-year highs in the process, back in February they posted a mixed 1H23 while reaffirming key guidance measures and the momentum, particularly at the top line (gross written premiums of $4.9bn up 8%) was good. The stock remains reasonably priced in our view, currently trading on an Est 13.7x PE for 2023, stripping out net proceeds from selling the Bank (i.e. estimated $4.1bn) implies SUN is extremely cheap compared to say IAG.

- The key risk however for SUN would be if ANZ walks from the deal to buy the bank. The value ascribed to regional banks has fallen substantially since the deal was launched, just look at the price of BOQ, and if the unlikely event happens that the deal does not complete, we would expect Suncorp (SUN) to fall sharply.