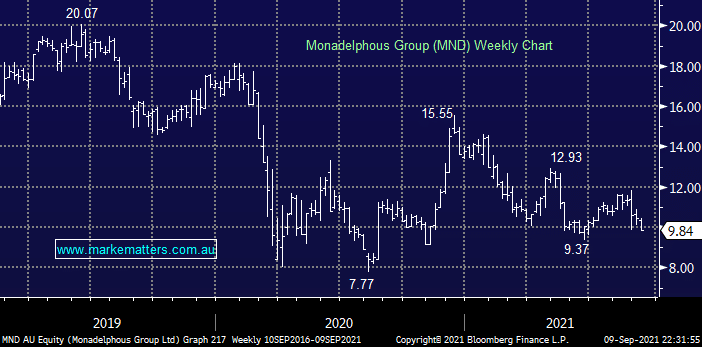

MM has focused on our Flagship Growth Portfolio this morning but we also hold reasonable cash levels in other portfolios which may spring into action if / when we do see opportunities arise if the current retracement is ongoing. We currently hold 7% of this portfolio in cash with one stock close to being cut which would increase this to 11% i.e. Monadelphous (MND) missed earnings by ~13% in August and we feel its going to take time to alleviate the margin pressure they are currently experiencing, hence taking a small ~5% profit and moving on makes sense as / when better opportunities unfold elsewhere.

scroll

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Close

Close

Thursday 11th September – Dow off -220pts, SPI off -20pts

Thursday 11th September – Dow off -220pts, SPI off -20pts

Close

Close

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Close

Close

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Close

Close

MM is considering cutting our 4% holding in Monadelphous (MND)

Add To Hit List

Related Q&A

Buy, Hold, Sell – CWY, MVF

Reporting update on 3 stocks- CRN, CAJ and MVF

Why did MM choose WOR over MND?

When a stock is not marked ‘Active’

Our view on NRW Holdings & Monadelphous Group (MND)

MM stance on Monadelphous (MND)

Monadelphous Group (MND)

Relevant suggested news and content from the site

Video

WATCH

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Recorded Friday 20th February 2026

Podcast

LISTEN

Thursday 11th September – Dow off -220pts, SPI off -20pts

Daily Podcast Direct from the Desk

Video

WATCH

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Recorded Wednesday 10th December

Podcast

LISTEN

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.