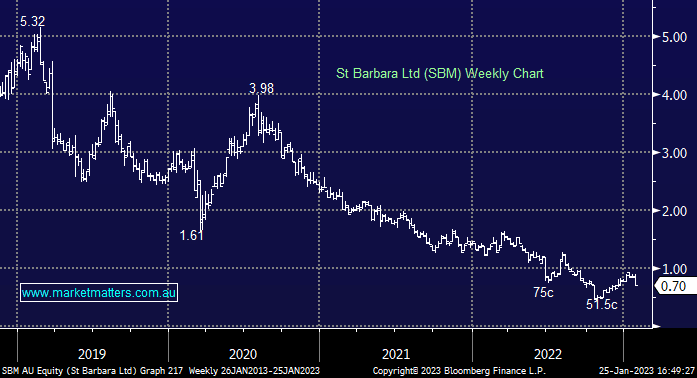

SBM -21.35%: the small-cap gold miner saw its shares tumble today after a disappointing production update. 2Q production was down ~5% on the previous quarter to 61koz, while costs rose 7% to $2,666/oz. While the company said most assets were performing in line with expectations, their main WA asset in Leonora saw lower grades than expected, causing both production to fall and costs to climb. As a result of the poor 2Q, St Barbara now expects production to come in at the low end of previous guidance and costs at the high end. St Barbara are currently in negotiations with Genesis (GMD) to merge their WA assets into a new entity, and spin out the remaining ‘non-core’ gold assets in Canada & PNG. We like the deal, however, the disappointing production numbers raise concerns around the economics.

scroll

Question asked

Question asked

Question asked

Question asked

Question asked

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Close

Close

Thursday 11th September – Dow off -220pts, SPI off -20pts

Thursday 11th September – Dow off -220pts, SPI off -20pts

Close

Close

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Close

Close

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Close

Close

MM is neutral SBM

Add To Hit List

Related Q&A

Thoughts on St Barbara (SBM) & Genesis (GMD) please

Thoughts on the 2nd tier gold shares please

Thoughts on SBM please

Is it time to exit SBM?

Where does MM see St Barbara (SBM) topping out?

Relevant suggested news and content from the site

Video

WATCH

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Recorded Friday 20th February 2026

Podcast

LISTEN

Thursday 11th September – Dow off -220pts, SPI off -20pts

Daily Podcast Direct from the Desk

Video

WATCH

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Recorded Wednesday 10th December

Podcast

LISTEN

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.