This week a new Gold company was announced (pending shareholder approval) called Hoover House (HHL) formed via a merger between St Barbara (SBM) which we own in the Emerging Companies Portfolio and Genesis (GMD) to consolidate their assets in the Leonora region of WA. Key points as follows:

– This is an all-scrip transaction via a “reverse” (compared to expectations) scheme of arrangement; GMD to receive 2.0338 St Barbara shares for each Genesis share.

– Separately, St Barbara is to undertake a demerger of Atlantic, Simberi and other assets (including St Barbara’s shares in various ASX-listed entities) to St Barbara shareholders in conjunction with the scheme, to be held in a company to be known as Phoenician Metals (PML), which intends to ASX list.

– The scheme is unanimously recommended by the GMD Board. The St Barbara Board intends to unanimously recommend the demerger.

– There is an attached capital raise on the Genesis side with GMD raising 275M to fund the merged entity and facilitate the transaction, the placement price is A$1.20 per share (~nil discount).

– HHL will have a med-term production target of +300kozpa, compared to SBM’s standalone FY23 production guidance of 145-160koz

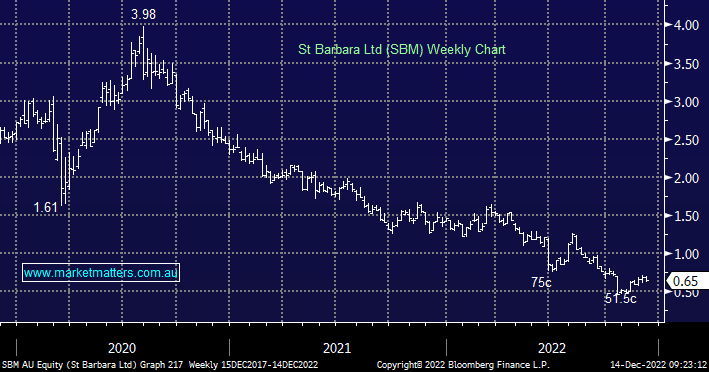

Overall, a smart, logical and sensible deal with a favourable long-term outlook, however, from the standpoint of an SBM shareholder having bought stock at 93.5c (as MM did), we think GMD is getting the better end of the stick with this deal, effectively picking up SBM at 0.5x book value when things were turning for the gold space, and SBM was very leveraged to that turn. That said, we would expect a post-deal pop in share price with 5.1% of SBM shares held short, making it the 32nd most shorted stock on the ASX, while the medium-term prospects are also positive.