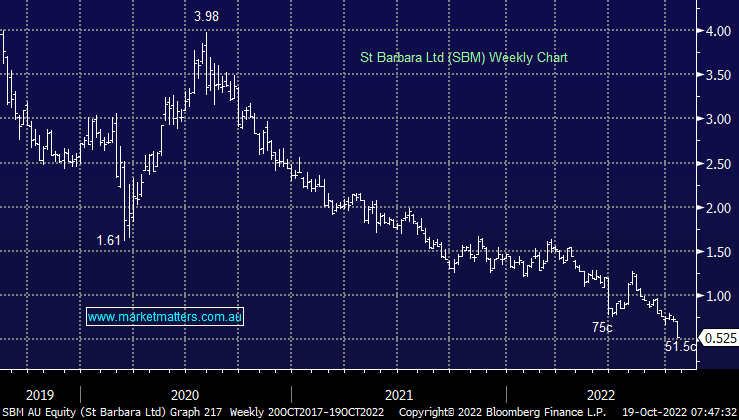

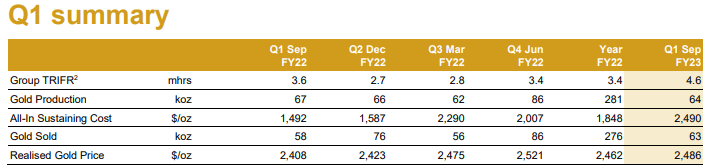

The junior Gold company had a very poor September Quarter producing 64k/oz of gold at an all-in sustaining cost of $2490/oz versus a realised gold price of $2486/oz. It does not take a lot of financial wizardry to realise these numbers don’t work, with the cost side a major issue. Lower production and a high fixed costs base are to blame but it does not change the outcome, and we understand why the stock fell ~20% yesterday.

They burnt through $30m in cash during the quarter, with around $90m sitting on their balance sheet – which is another concern. While the appeal here is around corporate activity within the Leonora mining hubs & SBM is now a very cheap way of buying reserves implying they may well get taken out, it’s hard to look past such a poor operational performance – we are likely to cut SBM from this portfolio.