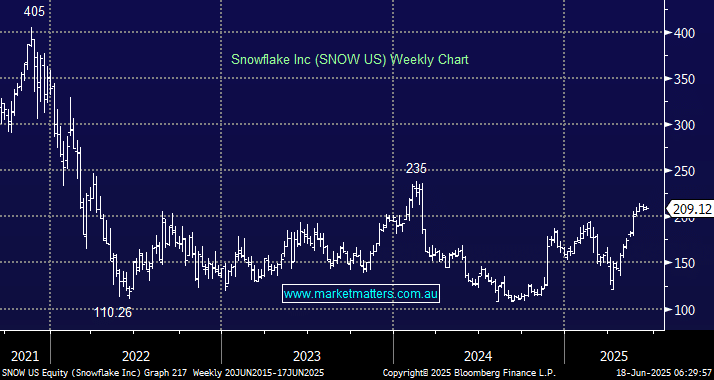

Snowflake is an exciting way to play AI, and we’ve held the stock in the past, unfortunately taking a loss when we sold out around a year ago. Our concern at the time was that a high level of investment in new capability and products would likely have an extended period before they would pay off, pressuring margins. We’re now about a year on, and these investments are starting to bear fruit, leading to a solid turnaround in both operational performance and share price.

This week saw UBS upgrade SNOW to a buy with a $US265 price target, citing strong momentum in a multi-year data infrastructure investment cycle driven by AI adoption. In a good note from an analyst we rate highly, they talk about how enterprise spending is increasingly being directed toward making corporate data “AI-ready,” with Snowflake, Palantir, and Databricks emerging as key beneficiaries. Snowflake’s newer products (like Snowpark, Cortex, and Dynamic Tables) are gaining traction, and its recent acquisitions (such as Crunchy Data for Postgres support) position it to broaden its offering beyond core data warehousing. While Databricks is a formidable competitor, they believe the market is expanding fast enough for both players to thrive.

As a refresher, SNOW offers a cloud-native platform known as the Data Cloud, which allows businesses to store and manage their own data, analyse it, and share it securely to build data applications that leverage AI and machine learning. Whereas Chat GPT, for instance, is open source, SNOW runs its own cloud-native architecture and doesn’t allow customers to view or modify the source code. Data is stored and processed within Snowflake’s environment, meaning your data resides in a controlled, managed “pool” that’s optimised by Snowflake, not shared more widely.

In terms of real-life examples, Snowflake allows a company to combine data from sales, marketing, finance, and operations into one place for easy reporting. For example, a retailer could pull sales data from different stores into Snowflake, then create dashboards for executives to better understand customer behaviour, preferences, and churn risk by analysing data from websites, apps, and support tools. Market Matters, for instance, could use Snowflake to analyse user login patterns, click-through rates, and conversions to determine ROI from marketing expenditure. As MM continues to expand our service offering, we could use it to maintain accurate transaction logs and produce risk reports for regulators, or gain more valuable insight into how people use the MM website, enabling us to continually improve the user experience.

- Recent company updates have been strong, and in the UBS note, they source very positive industry feedback. While the stock has run hard in recent months, they think the turnaround is only in its infancy, forecasting solid top-line growth of ~30%. We agree with their thesis, bringing SNOW back onto our Hitlist for the International Equities Portfolio.