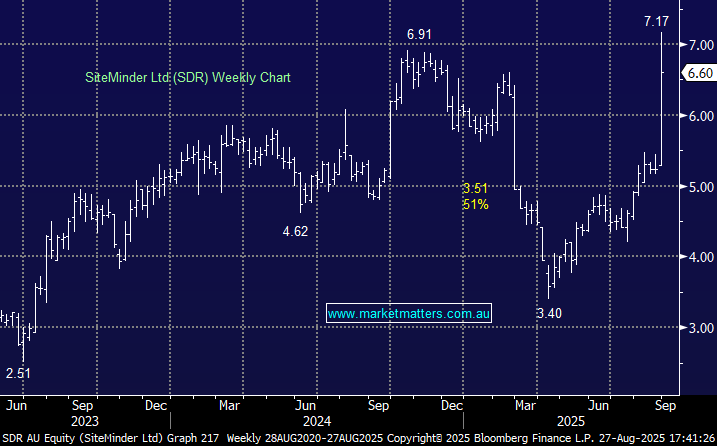

SDR +21.1%: shot up +32% following FY25 results and a positive FY26 outlook, supported by improving travel demand and guidance for recurring revenue growth.

- Revenue $224.3 million, +18% y/y and in line with consensus $224.1 million.

- Net loss $24.5 million, wider than Bloomberg consensus loss of $14.5 million, but a 2.5% y/y improvement.

- Underlying EBITDA $14.3 million, up sharply from $0.86 million y/y, and broadly in line with consensus $14.8 million.

- Annualised recurring revenue (ARR) $273 million, +31% y/y.

FY26 is set to benefit from both company execution and an improving travel backdrop, with momentum in ARR and revenue growth likely to support further re-rating. While losses remain, the trajectory is still in place to flip to positive cash flow in the near term.