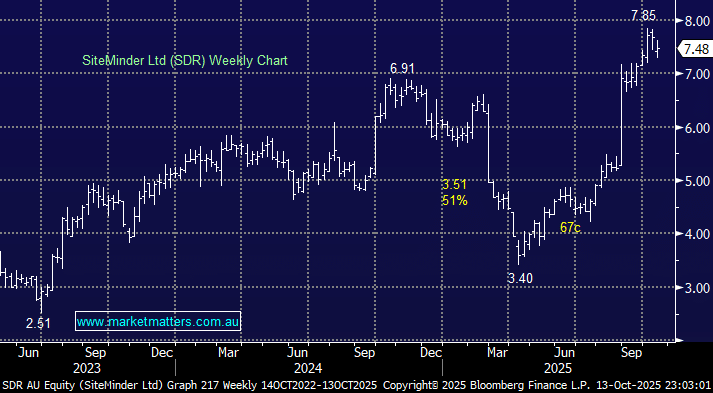

Unlike some tech stocks mentioned earlier SDR has remained firm of late but if the recent selling of ASX growth names spreads SDR could become a victim. SDR is another ~$2bn stock which MM holds in its Emerging Companies Portfolio, that now resides in the ASX200, making it a candidate for our Active Growth Portfolio. For subscribers not familiar with SDR, it’s a hotel technology company that provides cloud-based software to help hotels and other accommodation providers manage and grow their bookings. The company is growing nicely with FY26 revenue set to increase by ~26% even with 27% of last year’s revenue coming from the US, which has experienced soft conditions.

SDR soared higher in August after their FY25 result surpassed expectations, which saw revenue grow 18% to $224.3mn, and projected “strong” growth envisaged through FY26. With travel conditions improving, SDR enjoyed sharp upgrades following the result with Macquarie, one of the conservative ones, increasing its PT 33% to $8.11 – the stocks now enjoying plenty of broker support with 14 Buys and 2 Holds.

We’ve made a bullish comparison for SDR, which still holds: “While SDR isn’t yet profitable, it’s scaling well and reminds us of XRO in its infancy.” SDR is now at the inflexion point of becoming profitable, and we like stocks that are about the reap the rewards of multiple years of investment and scaling of their platforms.

- We remain believers in SDR over the medium term, with real earnings growth expected over the coming years.

- If looking to buy, the risk/reward is appealing in the $7 area, or around 5% below Monday’s close.