Metals recycling firm Sims reported improved first-quarter performance in its North American division, sending its stock up +12.4%. Despite ongoing challenges, in Australia and New Zealand, the metals businesses are forecast to deliver an Est. Ebit of ~$55mn in 1Q FY25 – ahead of expectations, with their North American operations the key driver. The same sort of rhetoric came from the ALS Limited (ALQ), which is involved in minerals testing, though strength in North America was not enough to offset weakness locally.

Last month, SGM reported a FY net loss of $57.8 million and slashed dividends amid export market pressure. It also sold its UK recycling business and stake in another business for $435 million. However, this improved first-quarter performance caught a pessimistic market on the wrong foot, and the stock spiked to fresh five-month highs.

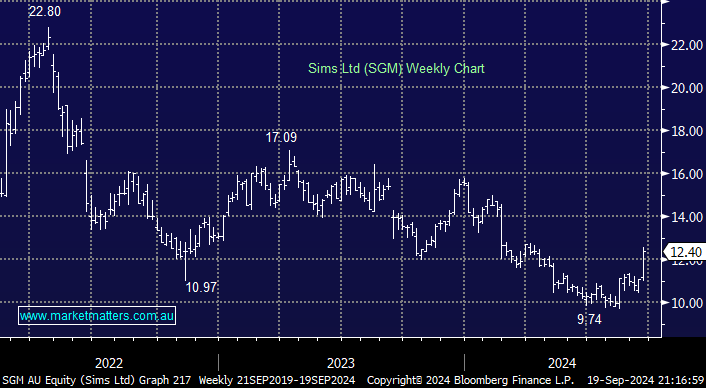

- We can see SGM addressing some of its last 2-year underperformance – a potential “turnaround story” that may play out.