SEK has struggled to keep pace with CAR and REA post-COVID, and the August FY24 results did not help; they delivered lower-than-expected earnings for FY24 and a decent downgrade to FY25 guidance. We regard SEK as a quality business, but it hasn’t figured on MM’s Hitlist due to lacklustre returns from overseas expansion and the clouded economic picture for the local economy.

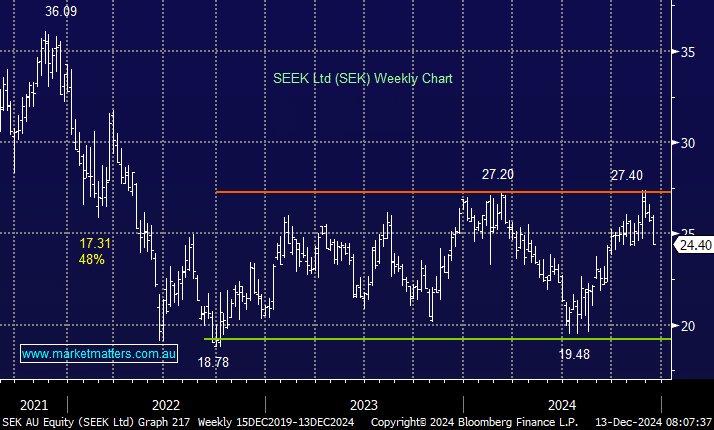

- We see no reason to fight the last few years’ sideways trend in SEK, especially with the stock towards the top end of the range.