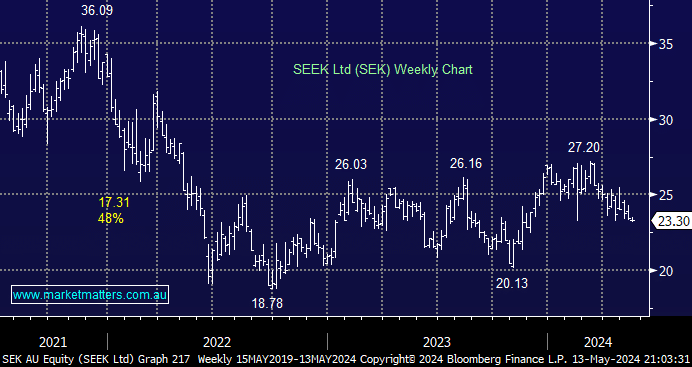

In February, SEK’s first half and outlook missed expectations due to a softer macro backdrop and falling volumes. The 22.5% drop in profit was a 6% miss to the street, which, combined with a cut in guidance, saw the stock endure a volatile few sessions; at the time, we said, “Seek remains expensive while facing declining earnings and macro headwinds”. However, after falling almost 10%, we’ve tweaked our view from “neutral/negative” to neutral, but importantly, we currently see no catalyst for MM to reconsider SEK just yet.

- We exited SEK in August of last year, just above today’s level. Since our exit, the ASX200 has rallied 5% before dividends – a net positive portfolio move.