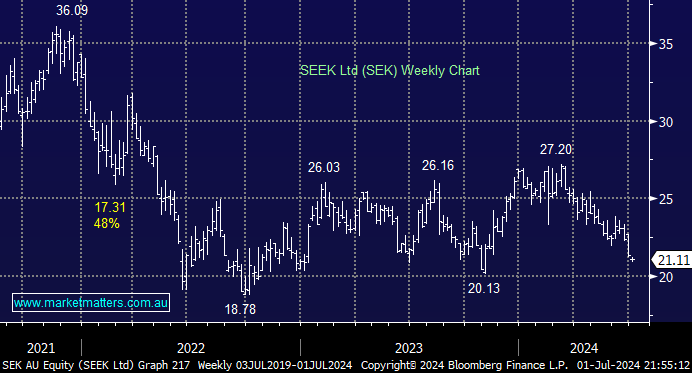

SEK has been under pressure all year as job ads continue to weaken and their Sth American growth strategy is wound back, something we had flagged several times previously as returns were mediocre. With the possibility of the RBA hiking rates again in 2024, we believe it’s too early to catch this particular falling knife—SEK is down 22% year to date in a market where technology has flourished.

From a valuation standpoint, SEK is trading on a PE of 31x, expensive relative to the market but cheap relative to its historical averages, though considering the worsening macro-headwinds, we don’t think there is any rush to buy the pullback.

- We see no reason for MM to consider SEK at this stage of the cycle, with a spike under $20, a strong possibility.