STO +10.92%: has been bid up by Abu Dhabi National Oil Co (Adnoc), via its investment unit XRG, making an all-cash $28.8 billion offer to acquire all outstanding shares at $8.89 per share – a 28% premium to Santos’ last closing price.

This has been cooking for a while, reportedly the 3rd bid by the group after multiple probes and continued due diligence revising offers up each time. Adnoc is no doubt wishing they cut to the chase to a higher bid with brent crude +11.5% in a week and the ASX Energy Sector up +10% in the past 2 sessions as the Israel-Iran conflict escalates.

Regardless, the deal will likely drag out and face regulatory scrutiny from the Foreign Investment Review Board (FIRB) due to the strategic nature of the assets – the market is pricing this risk accordingly with the stock now trading ~15% below the bid price.

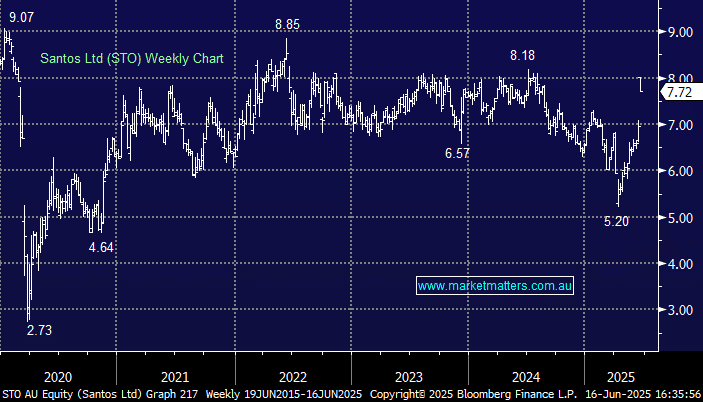

- We wouldn’t be rushing in to buy Santos here with plenty to play out between rising geopolitical tensions and the FIRB approval and suspect there will be plenty of sellers into strength given the stock has moved sideways for the past three years.