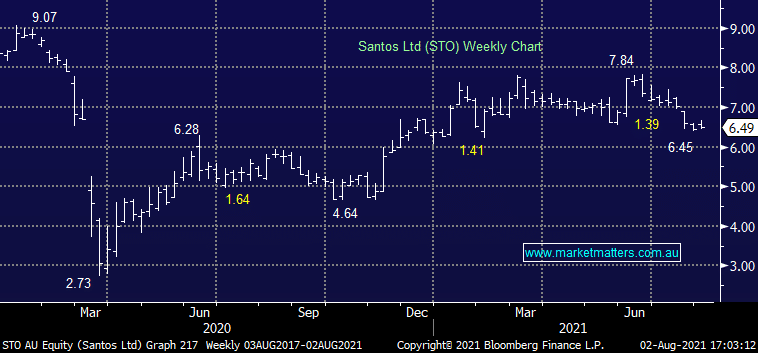

STO +0.62% / OSH +4.72%: merger talks between the two oil & gas companies have progressed with Santos revising their initial 0.589/sh offer higher to 0.6275 STO shares for each OSH share. The new number represents around a 17% premium to the close prior to the initial offer and would see Oil Search shareholders own 38.5% of the combined unit. The Oil Search board looks set to recommend the offer with 4 weeks of due diligence now underway. We like the deal as Santos shareholders, the combined group would launch into the top 20 oil & gas companies globally, making it easier to access capital and grow.

scroll

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Close

Close

Thursday 11th September – Dow off -220pts, SPI off -20pts

Thursday 11th September – Dow off -220pts, SPI off -20pts

Close

Close

iShares Soth Korea ETF (IKO) v BetaShares Hedged Japan ETF (HJPN)

iShares Soth Korea ETF (IKO) v BetaShares Hedged Japan ETF (HJPN)

Close

Close

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Close

Close

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Close

Close

MM is bullish STO

Add To Hit List

Related Q&A

Energy Stocks: Santos (STO), Beach Petroleum (BPT) and Woodside (WDS)

Energy Stocks: WDS, STO & BPT

Thoughts on the local energy stocks as crude continues to climb higher?

Why MM has reduced our energy exposure

Where to for crude oil?

What to buy with spare cash?

Relevant suggested news and content from the site

Video

WATCH

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Recorded Friday 20th February 2026

Podcast

LISTEN

Thursday 11th September – Dow off -220pts, SPI off -20pts

Daily Podcast Direct from the Desk

chart

iShares Soth Korea ETF (IKO) v BetaShares Hedged Japan ETF (HJPN)

Video

WATCH

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Recorded Wednesday 10th December

Podcast

LISTEN

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.