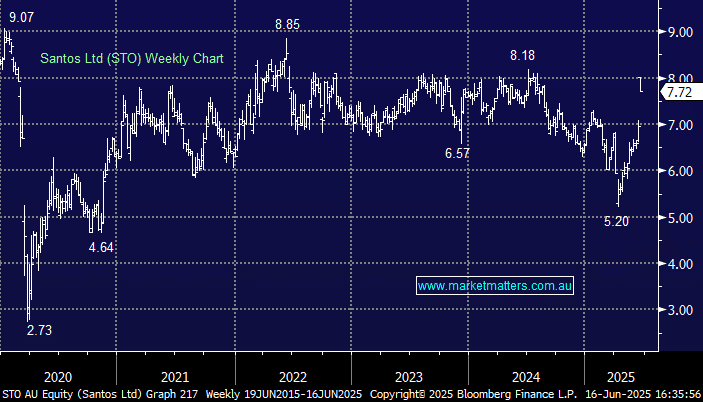

STO has received a bid from Abu Dhabi National Oil (ADNOC), equivalent to $8.89, a 28% premium to Friday’s close – we mentioned the possibility of a STO suitor in May. At a glance, yesterday’s $7.72 close looked disappointing, especially considering Santos’ board have recommended the cash offer, but there are a few hurdles still to jump:

- The deal still needs regulatory approvals, including clearance from Australia’s Foreign Investment Review Board (FIRB).

- Two previous bids for STO in 2018 and Woodside in 2023 fell over after due diligence – third time lucky?

We can only assume (dangerous word) that the latest bid from the XRG consortium will be different. We believe the 15% discount STO closed yesterday feels a bit pessimistic under the circumstances, although a higher bid isn’t expected with XRG being granted exclusive due diligence. We believe it’s now or never for STO, and the risk-reward looks acceptable if it slips further this week.

- We like the risk/reward towards STO into weakness, with $7 support likely to hold with the relatively firm oil price.