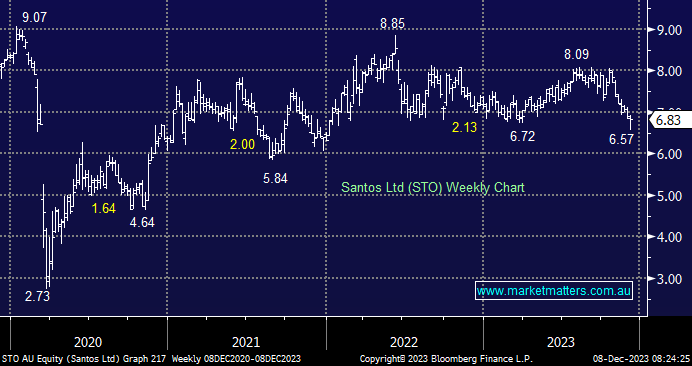

STO is in a very similar position to WDS, and although it appears more likely to benefit from future corporate activity, that is in itself not a reason to buy the stock for MM – we would be more interested around 10% lower from a risk-reward perspective, not an unrealistic objective if we see oil below $US70. STO and WDS face a significant capex burden over the medium term, but STO is heavier in a relative sense as it incurs ~$13bn of capex over the four years, 55% of its market cap; hence, we prefer WDS over STO as costs have a habit of “blowing out”.

- We have been targeting the $6-6.50 area for STO over recent months; hence, a bounce from current levels wouldn’t be a surprise.