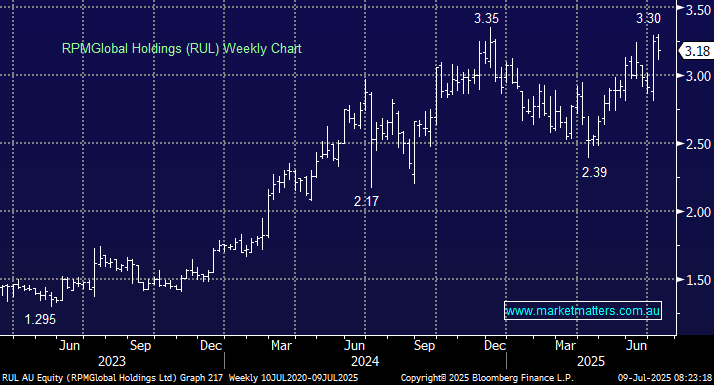

The provider of software solutions to the mining industry has had a volatile year, like many small caps, trading from below $2.40 to a high above $3.30, nearly a 40% trading range. The business has been a lot more stable than the share price gyrations would imply, and while there has been some large pieces of one-off news, such as the sale of their consulting business in April for $63mn, RPM has been steadily moving from perpetual licence fees (one off sales) in favour of recurring subscription licences. As we’ve written in the past, this creates some short-term revenue pain, but the long-term prize should ultimately be rewarded by investors, which is the basis for our thesis on the stock.

They provided an update on this transition last week (4th July), saying total contracted value sales for fiscal 2025 rose to $100.8mn, up from $77mn a year earlier, accounting for pretty much all new software revenue. Importantly, and this is the metric that gets investors excited, is that they now have annual recurring revenue of $69.1mn as of July 1. This creates an earnings profile that enhances their financial stability, and the benefit of compounding starts to take hold. They also highlighted a good increase in pre-contracted, non-cancellable software revenue backlog, which totalled $200mn, representing revenue that will be recognised in future periods, which further enhances their financial predictability.

RPM has a market capitalisation of ~$700m with net debt of ~$90m. While they are profitable now, it will take some time for the metrics covered above to fully hit the bottom line. That means some patience will be required, but so far, the last two years have seen strong execution in a change to their monetisation model, which should drive strong growth in earnings from FY26 onwards, in the range of 20-30% annually.

- As a refresher, their software is used in many facets of the mining game, from scheduling and mine planning to haulage optimisation, financial modelling and inventory management, using AI tools. This is an exciting growth company that has executed a significant transition in its sales strategy over the past 12 months.