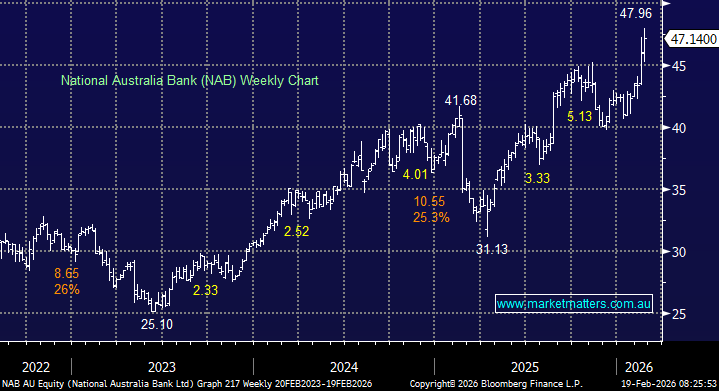

RRL is an aggressive play on the gold price as the 300% rally from its 2024 low, and recent sharp 16% correction illustrate. With an AISC of around $A2,400, there is plenty of margin for the miner, with the precious metal still trading around $A4,950. From a quality perspective, this is not our preferred miner, but it’s acutely leveraged to the gold price with ghosts of its hedge book well and truly gone. RRL has repaid its $300m debt facility and is now debt-free and unhedged, as we said, leaving it ideally positioned to benefit from the surging gold price – a high risk, high-reward option.

- We like RRL into dips back towards $4 as a high-beta gold stock.