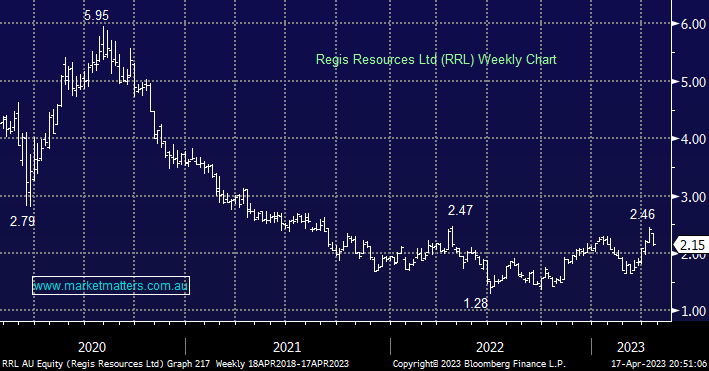

RRL fell -11.2% yesterday after downgrading production guidance following issues at 3 of their assets in the 3rd quarter plus costs and CAPEX were also revised up. As the share price reaction suggests the update was well short of expectations. We have been advocating buying gold and respective exposure into pullbacks but in this case of bad operational performance we do not have any interest in catching the falling knife i.e. year-to-date RRL is up +4.4% compared to EVN which is up almost +20%, as we said earlier we are in a market where the best returns are coming from the stronger companies.

- We still prefer the quality end of town for gold exposure i.e. Evolution Ming (EVN), Newcrest Mining (NCM), and Northern Star Resources (NST).