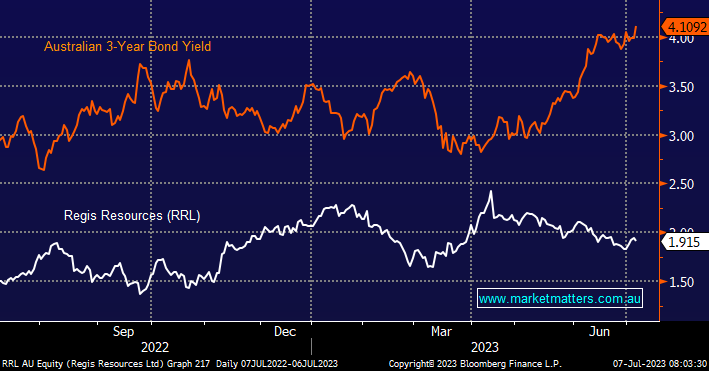

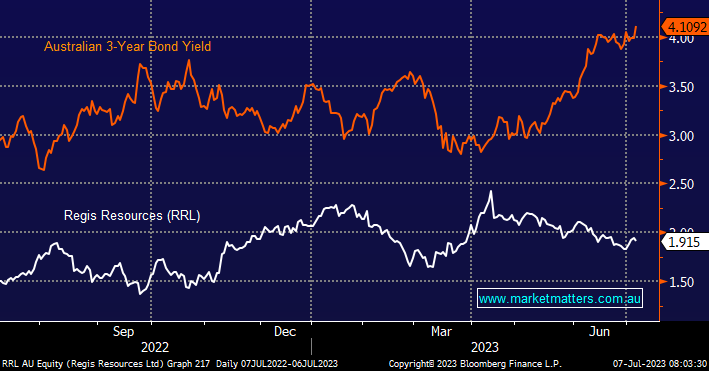

RRL downgraded production guidance in April which explains the stock’s underperformance compared to its peers. We have been advocating buying gold and respective exposures into pullbacks, but when the decline is a result of operational weakness rather than broader macro-economic factors, we become more cautious. That said, when operational issues get ironed out, these are the stocks that can recover the strongest.

- RRL is very leveraged to higher gold prices, with every +US$100/oz to our long-term real gold price adding 30c to their value i.e. if yields fall & gold rises RRL should rally strongly.

- We like RRL into current weakness believing the next 30% move is on the upside.

NB: We currently hold gold exposure in our Flagship Growth Portfolio via Newcrest (NCM) and Evolution (EVN) plus Silver Lake Resources (SLR) in our Emerging Companies Portfolio.